Estimated learn time: 20 minutes, 57 seconds

That can assist you select between Stripe vs. Paddle vs. FastSpring, this information compares:

- What areas of the fee lifecycle every one gives an answer for (e.g., fee processing, gathering and remitting taxes, and subscription administration) and what extra software program you’ll want so as to add to your tech stack.

- What corporations and industries every one serves.

Then, we offer an in depth comparability of key options similar to checkout and reporting. Lastly, we share a number of buyer opinions and case research for every resolution.

In a nutshell, Stripe primarily offers with fee processing, whereas FastSpring and Paddle deal with fee processing, subscription administration, gathering and remitting tax, fraud safety, and way more with out the necessity for extra software program.

Desk of Contents

Observe: Info on this article is true on the time of writing however is topic to alter.

FastSpring handles the whole lot from sustaining excessive authorization charges to paying end-of-year consumption taxes for SaaS corporations. Join a free account or request a demo at this time to see how FastSpring will help you broaden globally.

What areas of the fee lifecycle will you have the ability to handle and what different software program will you want for a whole fee resolution?

Stripe: Fee Processing

Stripe is finest identified for fee processing, which means they aid you acquire fee particulars and get funds licensed. As well as, additionally they provide a couple of primary options for subscription administration, fraud detection, invoicing, and extra.

These extra options can fulfill the wants of some early-stage startup corporations, nonetheless, most corporations find yourself needing extra sturdy choices. Ultimately, you’ll want extra software program to handle advanced recurring billing wants, settle for extra fee strategies world wide, or create a personalized checkout course of. Fortunately, most builders discover it straightforward to combine Stripe with most different software program (nonetheless, it’s a must to pay for every software program individually).

Most corporations utilizing Stripe additionally want extra employees to handle gross sales tax (and VAT) and regulatory compliance. Whereas Stripe gathers gross sales tax and VAT for you, you’ll be liable for remitting it. When you remit these taxes within the incorrect quantity, on the incorrect time, or within the incorrect method, you might face monetary loss and penalties. (Extra on this later.)

Plus, you’ll be liable for staying updated and adhering to the native legal guidelines and rules the place your clients stay. It is a big enterprise for any firm which is why most corporations dedicate a complete division to the duty.

FastSpring: The Whole Fee Lifecycle

Not like Stripe, with FastSpring, you’ll have entry to:

- A number of fee processors (which improves authorization charges and makes it simpler to transact globally).

- Versatile subscription administration and recurring billing instruments.

- B2B digital invoicing.

- Superior fraud detection.

- Totally customizable checkout.

- Detailed experiences and analytics.

- And way more.

Plus, we act as your Service provider of File (MoR), which means we tackle transaction legal responsibility for you. We acquire and remit gross sales tax and VAT in your behalf, and take the lead on regulatory compliance and audits.

You’ll have the ability to handle all elements of the fee lifecycle out of your FastSpring dashboard with out including additional software program or headcount.

Paddle: A lot of the Fee Lifecycle

Paddle gives options for fee processing, subscription administration, and fraud detection, and is extra feature-rich than Stripe’s options. Nevertheless, a few of Paddle’s options are much less sturdy than FastSpring’s options. For instance, FastSpring’s checkout is extra customizable than Paddle’s checkout choices (extra on this later).

If Paddle doesn’t provide the performance you want, you could want so as to add extra software program or change to a distinct service.

Like FastSpring, Paddle is an MoR.

Associated: SaaS Billing Software program: 7 Instruments in 3 Classes & The way to Select – FastSpring

What Forms of Companies and Which Industries Can Use Every Platform?

Stripe: Almost Any Enterprise

Stripe can be utilized by almost any kind of enterprise in almost any business. Nevertheless, SaaS corporations will inevitably run into a couple of struggles whereas utilizing Stripe.

As we talked about earlier, corporations utilizing Stripe are totally liable for remitting gross sales tax and VAT. It was once true that SaaS corporations didn’t must remit gross sales tax or VAT, nonetheless, many states and nations are creating (and strongly implementing) new legal guidelines that require SaaS corporations to remit gross sales tax or VAT.

Listed below are two examples:

- On January 1, 2015, the European Union started requiring software program sellers to gather and remit VAT primarily based on the placement of the customer — not the placement of the vendor’s firm or staff.

- In 2018, the United States Supreme Court docket dominated that states could cost gross sales tax on purchases created from out-of-state sellers (together with on-line sellers), even when the vendor doesn’t have a bodily presence within the taxing state.

Retaining monitor of and adhering to always altering tax legal guidelines is a tough problem. That’s why SaaS corporations (and corporations promoting any digital merchandise) are higher off selecting an answer like FastSpring that may deal with remitting gross sales tax and VAT for you.

FastSpring: B2C and B2B SaaS or Digital Items Firms

For almost 20 years, FastSpring has been serving B2C and B2B corporations promoting SaaS, digital merchandise, and downloadable software program:

- Mailbird achieved over 100% progress by switching from Stripe to FastSpring. The pliability of the platform and the flexibility to remain compliant with tax legal guidelines, have been the primary causes Mailbird selected FastSpring. Learn the Mailbird case examine right here.

- NotePlan elevated conversions by over 60% by switching from Paddle to FastSpring. FastSpring supplied a number of checkout, localization, and coupon options that NotePlan wanted. Plus, our workforce offered customized suggestions for tactics NotePlan may enhance their checkout expertise to optimize conversions. Learn the NotePlan case examine right here.

- SocialBee doubled their month-to-month recurring income and managed tax compliance by switching from Braintree to FastSpring. As soon as the SocialBee workforce realized they wanted greater than a fee processor, partnering with FastSpring was a straightforward selection. Learn the SocialBee case examine right here.

Paddle: B2C SaaS

Paddle has been serving SaaS corporations for about ten years. Paddle’s platform is best fitted to B2C corporations, nonetheless, they’re engaged on including new options for B2B corporations, similar to automated invoicing.

If including B2B companies is in your future, these options could also be established by the point you want them. Nevertheless, in the event you’re already promoting B2B merchandise, you could need to think about an alternative choice with totally functioning B2B options (FastSpring’s Digital Invoicing instrument for B2B has been stay for a number of years).

Subsequent, we evaluate Stripe vs. FastSpring vs. Paddle, in keeping with particular options.

Performance and Characteristic Comparisons

Fee Processing (Fee Strategies, Currencies, and Extra)

Stripe

To start out processing funds with Stripe, it’s a must to configure every location with the forex and fee strategies you need to provide in that location. As soon as arrange, Stripe will routinely convert product costs and show the proper forex and fee choices at checkout.

Stripe helps 135+ currencies.

You’ll have the ability to settle for funds from main bank card networks (together with MasterCard and Visa), financial institution transfers, vouchers, and fashionable wallets like Apple Pay and Google Pay. Nevertheless, they don’t assist PayPal.

Stripe additionally helps in-person transactions by way of the Stripe Terminal and cellular SDKs.

FastSpring

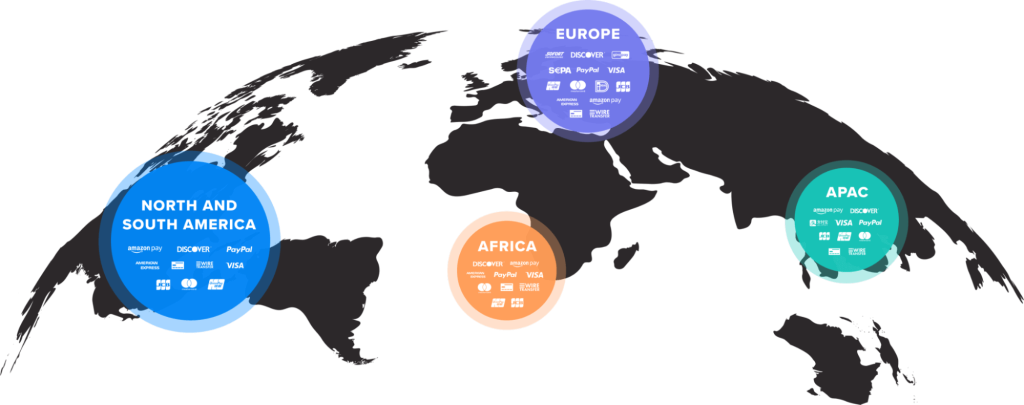

FastSpring makes it easy for SaaS and ecommerce corporations to just accept funds in most currencies and most popular fee strategies world wide. As a substitute of configuring every one individually, FastSpring sellers can merely activate localized funds and begin accepting world funds instantly.

Whereas Stripe routinely converts costs to the native forex for you, FastSpring gives extra flexibility:

- You’ll be able to let FastSpring make the conversions for you, or you’ll be able to set a set worth for every of your merchandise in every forex.

- You’ll be able to let FastSpring select the suitable forex primarily based on the person’s location, you’ll be able to select a selected forex for every location, or you’ll be able to let the client select their most popular forex. FastSpring helps 23+ currencies.

With FastSpring, clients could make funds utilizing:

- Bank cards together with Visa, MasterCard, American Categorical, Uncover, JCB, and UnionPay.

- ACH.

- SEPA Direct Debit.

- Wire transfers.

- Wallets together with PayPal, Apple Pay, Amazon, Alipay, and extra.

Lastly, not like Stripe which is a single fee processor, FastSpring connects to a number of worldwide fee gateways, which improves the probability {that a} fee shall be licensed.

Funds have the next success charge when the fee gateway is in the identical location as the customer. FastSpring routinely routes on-line funds by the gateway with the best authorization charges for that fee technique and placement.

Plus, utilizing a number of fee gateways solves most failed fee points which are on account of community errors. If a fee gateway is experiencing a technical failure, FastSpring routinely retries the fee utilizing a distinct gateway — with out your workforce having to carry a finger.

Bonus: FastSpring Companions with Sift

FastSpring takes the lead on fraud and danger actions (together with chargebacks). We companion with Sift, a world chief in danger evaluation and fraud prevention, to maintain your transaction safe. Sift makes use of machine studying and AI to:

- Improve accuracy in fraud selections.

- Enhance approval charges and lead to fewer false positives.

- Cease dangerous actors earlier than a transaction is even processed.

FastSpring additionally blocks transactions from nations and jurisdictions the place corporations are at the moment not allowed to do enterprise.

Paddle

Paddle additionally makes use of a number of fee gateways and lets corporations settle for world funds with minimal setup.

Paddle helps 20+ currencies, fashionable bank cards (together with MasterCard, Union Pay, and extra), wire transfers, and wallets (together with Apple Pay, Google Pay, PayPal, and Alipay) — though a few of these choices are nonetheless in beta testing.

Calculating and Remitting Gross sales Tax, VAT, and GST

Stripe

Stripe acquired TaxJar that will help you calculate gross sales tax, VAT, and GST. Nevertheless, they solely present directions for enabling tax options and assigning tax codes. You’re liable for the selections and implications of utilizing these options (e.g., understanding how your product is assessed underneath tax legislation and if/the place you may have nexus, have to register, acquire, file, and submit consumption tax). If in case you have questions on learn how to optimize tax charges, qualify for lowered tax charges, or another tax-related query, you’ll doubtless be advised to seek the advice of your tax advisor or learn by the assistance articles.

When you by chance set it up incorrectly and acquire the incorrect quantity (or kind) of tax, you’ll be held liable.

Plus, remitting gross sales taxes is usually extra concerned than filling out a easy spreadsheet and writing a verify. Increasingly nations are mandating extra necessities to remain compliant. For instance:

- Nations similar to Colombia, Japan, Mexico, Serbia, and others require native illustration, which means it’s a must to rent somebody with a bodily presence in that nation to be liable for your tax legal responsibility. This may value anyplace from $5k to $15k per 12 months.

- Nations similar to India, Indonesia, Japan, and others require your account to be “pre-funded” which means it’s a must to predict the quantity of tax you’ll owe and hold that cash in your account till it’s time to file (as much as three months upfront).

- Nations similar to Serbia, United Kingdom, Taiwan, and others require digital invoicing (it applies to non-resident corporations, as properly). This sometimes prices corporations $2k-$5k per 12 months. Observe: E-invoicing mandates are growing at an alarming charge — with the EU rolling out common digital invoicing necessities by 2028.

- Nations similar to Taiwan, Indonesia, Nigeria, Vietnam, and others require you to fileearnings taxas well as to oblique tax (this will add as much as $5-$10k per 12 months).

Lastly, wiring worldwide tax funds just isn’t straightforward or free. The corresponding and receiving banks each cost charges and there’s the extra danger concerned with international transactions.

So, whereas Stripe has taken an necessary step in the direction of serving to you acquire gross sales tax by buying TaxJar, they’re a great distance from offering an end-to-end resolution for gross sales tax and worldwide tax.

FastSpring

FastSpring handles your entire strategy of gathering and remitting gross sales tax, VAT, and GST for you.

With over 20 years of expertise submitting 1,200+ tax returns every year, our workforce ensures the correct quantity (and kind) of oblique tax is being collected at checkout — we even deal with tax-exempt transactions within the U.S. and 0% reverse costs when allowed internationally.

FastSpring recordsdata and collects taxes in 52 nations, 13 provinces, and all 45 U.S. states that acquire gross sales tax (5 states don’t acquire any gross sales tax).

Then, our workforce remits these taxes for you and ensures all the required procedures are in place to remain compliant. If a rustic or state approaches you about tax compliance, our workforce will advise you on learn how to reply — even so far as offering copy-and-paste responses.

We construct and keep relationships with tax legislation specialists the world over to verify we’re conscious of legal guidelines and rules as they modify.

Bonus: Customized Tax Codes

Instruments like TaxJar, Avalara, and different tax software program give you tax codes for many services and products. Nevertheless, most corporations will ultimately need to provide a services or products that doesn’t match neatly into the outline of any of the tax codes offered (e.g., an in-person convention with some digital attendees and audio system). By utilizing a instrument like TaxJar, you’ll be by yourself to calculate and acquire the correct amount and kind of oblique tax since they gained’t have a tax code on your distinctive scenario.

This isn’t a problem for FastSpring sellers as a result of we lately rolled out a characteristic that permits us to construct distinctive product tax codes personalized by use case — inside minutes. Simply inform us about your services or products and we are going to create the tax code for you.

Paddle

Like FastSpring, Paddle takes the lead on gathering and remitting gross sales tax, VAT, and GST for you. Not like FastSpring, Paddle doesn’t assist tax exempt instances within the U.S.

Checkout

Stripe

Stripe Checkout is a prebuilt fee web page designed to be used on any machine. You’ve a couple of choices for personalization (e.g., font, block shapes, colours, and so on.) nevertheless it’s fairly restricted. Stripe routinely interprets Checkout to the suitable language (35+ choices) primarily based on the customer’s location.

FastSpring

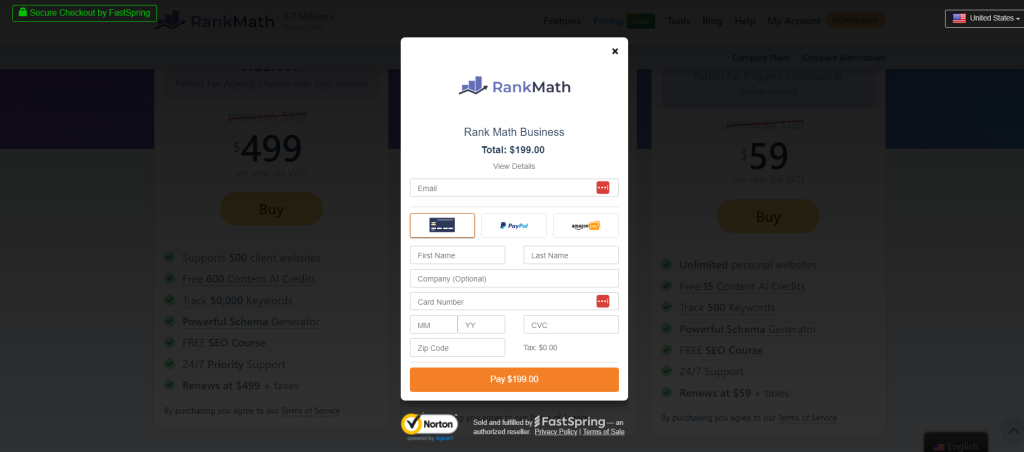

FastSpring permits you to customise your checkout, from customized fields to customized colours utilizing our branding instruments and CSS overrides. You even have the flexibleness to decide on whether or not you need to give your developer full management over checkout or let FastSpring handle it for you (or someplace in between).

Right here’s an summary of FastSpring’s checkout choices:

- Three variations: You’ve the choice to embed checkout instantly in your webpage, use a popup checkout, or redirect your clients to a Net Storefront managed by FastSpring.

- Retailer Builder Library (SBL): FastSpring’s JavaScript library permits you to construct FastSpring components into your web site earlier than the customer reaches checkout. For instance, you’ll be able to implement an upsell funnel or dynamic pricing slider. This allows you to customise every step of the customer journey.

- Localized Checkout: Let clients select their most popular language or let FastSpring select the suitable language primarily based on the customer’s location. FastSpring helps 19+ languages.

- Constructed-in monitoring and testing instruments: With FastSpring’s built-in monitoring instruments, you’ll be able to simply determine methods to enhance conversion charges. Most corporations that use this instrument are in a position to enhance their conversion charges by 30% or extra.

- Customized buyer assist: Though we provide you with full management over your checkout, our workforce is at all times out there that will help you construct one of the best checkout expertise for your small business. Some corporations solely present customized assist to their largest shoppers and virtually ignore small companies. At FastSpring, we don’t play favorites. Our workforce is at all times joyful to assist in any method they will.

Paddle

Paddle gives two variations of checkout:

- Embedded in your webpage

- Popup overlay

Inside these two codecs, they provide 50+ choices for personalization. Paddle helps 16 languages and routinely interprets your checkout.

Subscription Administration

Stripe

Stripe Billing features a few completely different subscription choices:

- Flat-rate billing (for a month-to-month or annual worth)

- A number of worth billing (the place a single product is offered for various costs in several places)

- Per seat billing (primarily based on energetic customers in the course of the billing cycle)

- Utilization-based billing (single unit or tiered)

- Flat-rate + overage (a mix of flat-rate and usage-based billing)

These choices work for some corporations that solely have a couple of easy subscription-based merchandise, nonetheless, corporations with extra advanced recurring billing wants (e.g., SaaS) usually want a further instrument. To this finish, Stripe has developed an in depth partnership with Chargebee in order that it’s simpler for his or her clients to get the subscription billing instruments they want. Though it’s very easy to combine these two instruments, you’ll have to handle and pay for each individually.

Lastly, Stripe gives a buyer portal the place clients can handle their accounts (each FastSpring and Paddle provide this as properly).

Associated: 8 Greatest Chargebee Alternate options and Opponents (And How They’re Completely different)

FastSpring

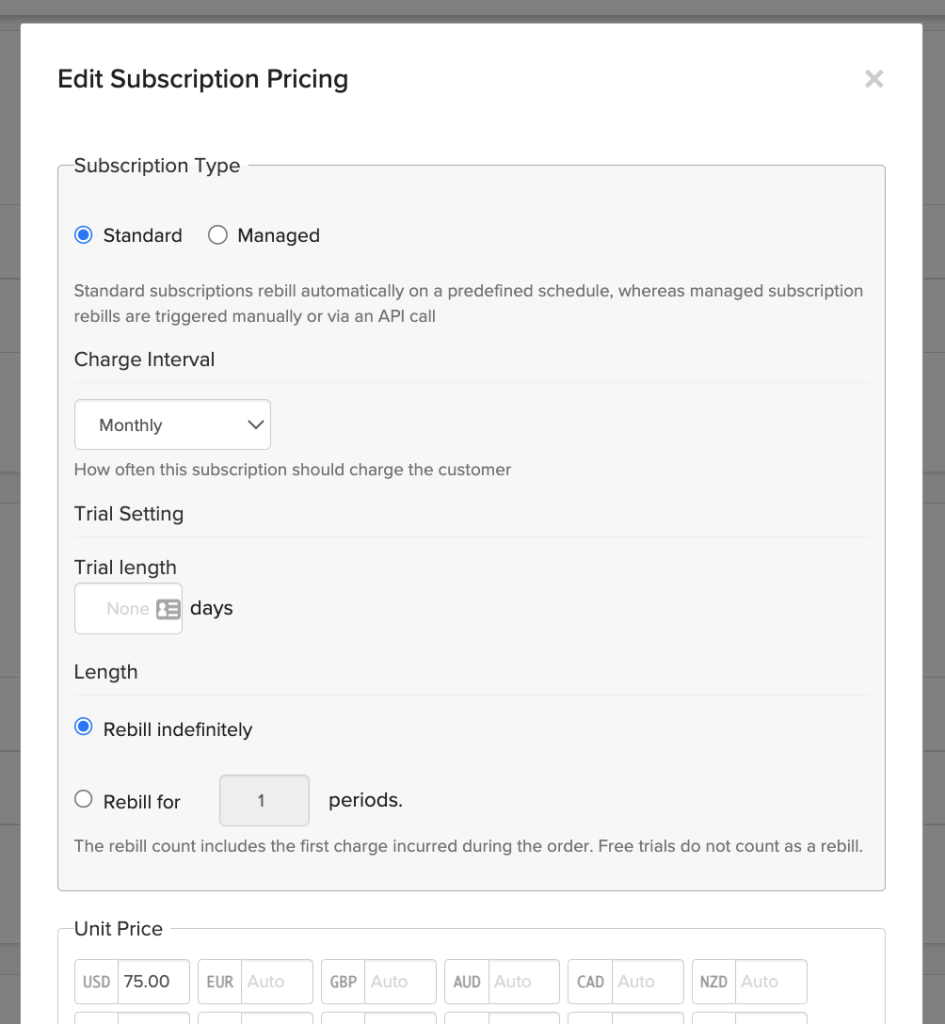

FastSpring gives all kinds of subscription administration choices constructed particularly for SaaS corporations.

Plus, most of those choices could be arrange with out writing any code. For instance, you’ll be able to arrange:

- Computerized weekly, month-to-month, or yearly recurring billing.

- Prorated billing to accommodate upgrades — and downgrades — mid-cycle.

- Free or paid trials of any size.

- Trials with or with out gathering fee particulars (by not gathering fee particulars, you’re decreasing friction at checkout, which generally results in increased conversion charges).

- Computerized or guide renewal.

- Upsells, cross-sells, one-time add-ons, and reductions.

- And way more…

Additionally, you will have entry to our API and webhooks library for extra customization choices.

One main level that usually will get neglected is whether or not or not your recurring billing mannequin follows native transaction legal guidelines and rules.

For instance, the Reserve Financial institution of India (RBI) has very particular rules concerning recurring funds. On the time of writing, the RBI limits automated recurring funds to ₹15,000 (roughly $180). If a fee is over that quantity, the client should approve every transaction manually. You additionally must file an official mandate with the RBI that outlines the procedures you may have in place to make sure compliance. When you don’t file a mandate or have clients manually approve massive transactions, you might face heavy fines or be prevented from promoting to clients in India.

Whereas some subscription administration instruments will launch neighborhood updates every time they study new rules, you’re the one held liable for retaining monitor of and adhering to all legal guidelines and rules. When you don’t comply, you might face fines or be banned from doing enterprise in that jurisdiction. Most corporations want extra headcount to handle this.

FastSpring clients don’t have to fret about this as a result of we tackle transaction legal responsibility for you.

Our workforce of authorized specialists stays updated on all related legalities, ensures the required procedures are in place, takes the lead on audits, and gives particular person steering on learn how to keep compliant — all at no extra value.

Associated: Worldwide Recurring Funds (How We Deal with It for You)

Bonus: Digital Invoicing

FastSpring’s Digital Invoicing (DI) permits you to handle B2B orders alongside B2C purchases. With DI, you’ll be able to:

- Create and handle customized quotes in actual time (together with customized tags, coupons, reductions, and extra).

- Set quote expiration dates.

- Request and settle for fee.

- Add customized notes on your buyer/prospect.

- Present a self-service quote widget (that is particularly helpful when clients want approval earlier than buying).

- And way more.

Paddle

Utilizing a collection of webhooks and their API, Paddle helps the next subscription fashions:

- Mounted

- Tiered

- Per-seat

- Metered

Plus, a few of these choices could be mixed. For instance, you might have a tiered product the place every tier permits for a distinct variety of seats.

Paddle helps free or paid trials, nonetheless, clients shall be required to offer fee particulars to be able to begin the trial. Paddle additionally routinely applies prorated quantities when clients change their plan mid-cycle (e.g., add new customers or improve).

Associated: An In-Depth Information to Subscription Billing Platforms (+ 5 Choices)

Reporting and Analytics

Stripe

Stripe gives a set of income recognition instruments that will help you streamline accounting, together with:

- Normal accounting experiences, similar to steadiness sheets and earnings statements.

- Configurable income guidelines, similar to excluding passthrough charges and auto-adjusting recognition schedules.

- Income overview experiences.

- And extra…

All experiences could be considered in your Stripe dashboard and a few experiences could be downloaded as a CSV file. You can even combine with fashionable accounting instruments similar to QuickBooks Desktop and Xero. Nevertheless, the flexibility to import information from different income recognition suppliers into Stripe continues to be in beta.

FastSpring

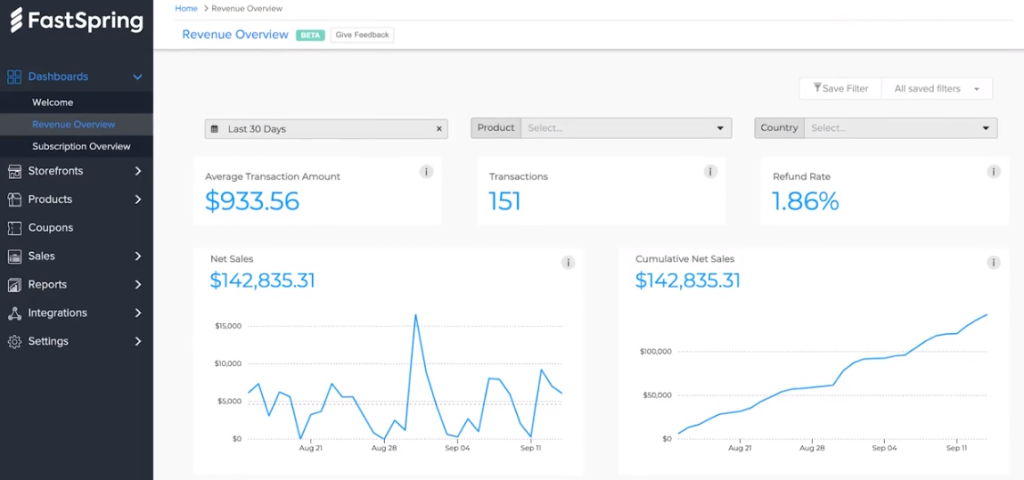

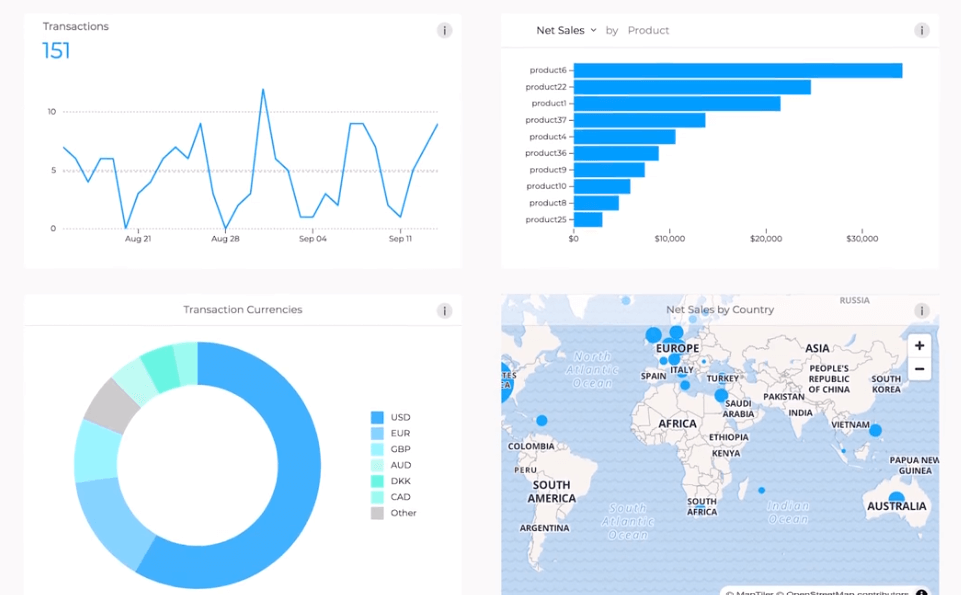

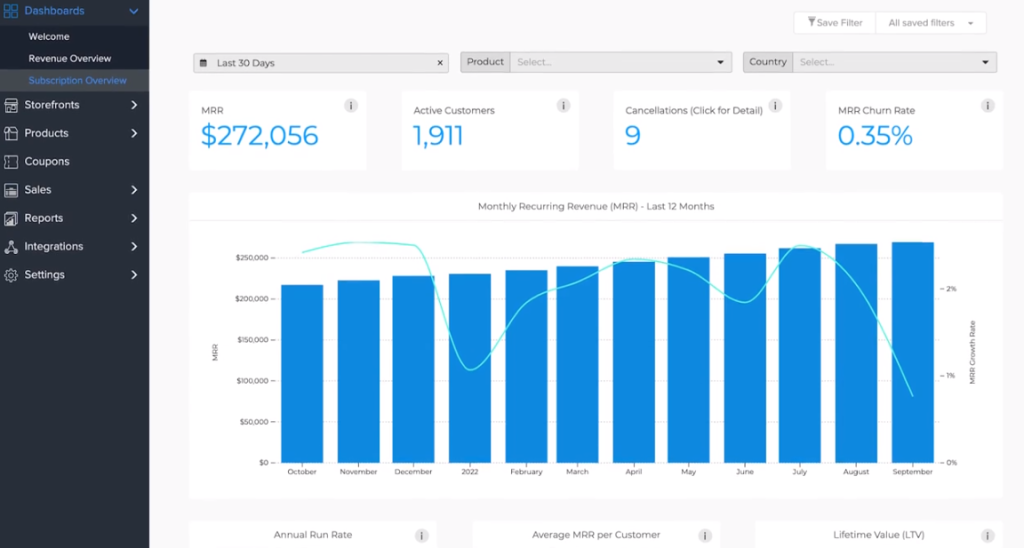

FastSpring Reporting and Analytics is a sturdy suite that helps you perceive:

- How every product contributes to your backside line.

- When clients are almost certainly to drop off.

- What coupons or promotions are working.

- Which subscription fashions generate probably the most income.

- The place your clients are situated.

- What currencies and fee strategies clients want.

- And way more…

Most of this info could be present in one in all two dashboards: the income overview dashboard or the subscription overview dashboard.

The income overview dashboard incorporates extra normal info similar to whole transactions by nation or internet gross sales by product.

The subscription overview dashboard permits you to drill down into extra particular particulars like energetic clients or month-to-month recurring income (MRR) over time.

When you don’t see the precise report you want in these dashboards, you’ll be able to create and save customized experiences. Or, you’ll be able to attain out to our workforce and we’ll aid you discover (or construct) the report you want. Any report could be considered in your dashboard or downloaded as a CSV, PNG, or XLSX file.

Paddle

Paddle lately acquired ProfitWell to be able to present reporting and analytics options. Nevertheless, the combination isn’t full, so there shall be some discrepancies between platforms. For instance, they may present completely different MRR.

As soon as totally built-in, Paddle will have the ability to:

- Mechanically monitor and report on key efficiency indicators, similar to MRR.

- Monitor person engagement and churn.

- Present benchmarking and segmentation instruments.

- And extra…

Pricing

Stripe

As a DIY platform, Stripe’s pricing works a lot in another way than FastSpring or Paddle. With Stripe, you’ll have to pay for extra software program and headcount to handle different elements of the billing lifecycle similar to superior fraud detection, subscription administration, remitting gross sales tax and VAT, and extra.

Stripe additionally at the moment costs playing cards and wallets in another way than different fee strategies similar to ACH and SEPA.

With all of those fee strategies, you’ll have entry to lots of their companies however not all of them. For instance, Stripe costs extra charges for 3D-secure transactions, invoicing, tax options, and extra.

To study extra about Stripe, go to their web site.

FastSpring

With FastSpring, you’ll have entry to the whole platform (and all companies) for one flat-rate payment. Since we tackle transaction legal responsibility for you and take the lead on gross sales tax and VAT, you gained’t want any extra software program or headcount.

Our workforce works with you to seek out an reasonably priced worth primarily based on the amount of transactions you progress by FastSpring. Plus, you’ll solely be charged when transactions happen.

Attain out to our workforce to seek out the speed that works for you. You can even preview FastSpring options by establishing a free account.

Paddle

Paddle advertises a flat-rate payment for his or her core product which incorporates a lot of the options you’ll need — funds processing, checkout, subscriptions, world tax and compliance, fraud safety and reporting, and extra — nevertheless it doesn’t embody the whole lot.

For instance, Paddle collects a 10% fee to get better deserted carts.

To study extra about Paddle, go to their web site.

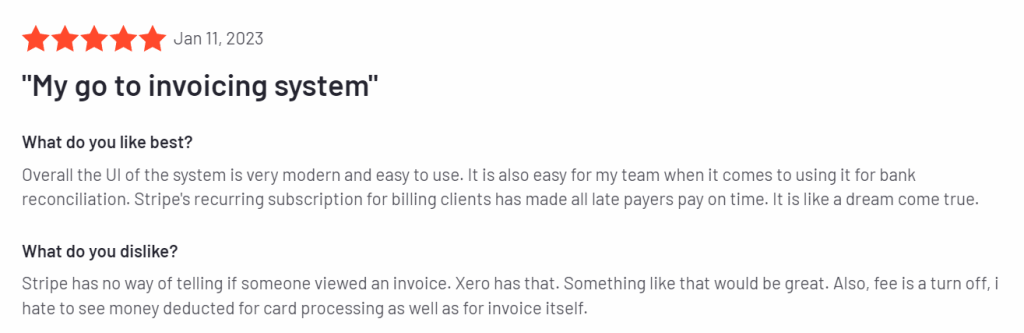

Buyer Evaluations

Stripe

Stripe at the moment has 4.4 stars on G2 (a preferred software program assessment website) with 82+ opinions.

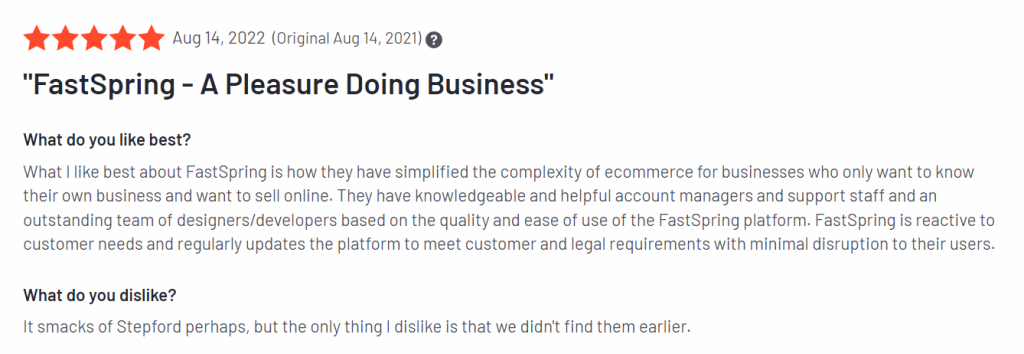

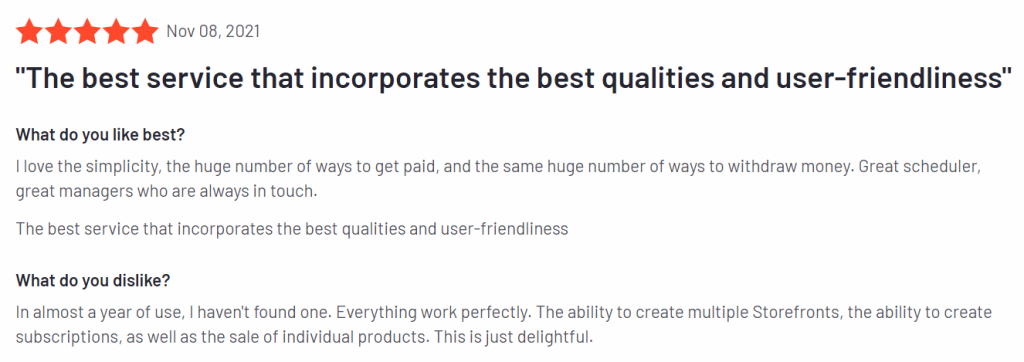

FastSpring

FastSpring at the moment has 4.5 stars on G2 with 184+ opinions.

Right here’s what a few of our clients needed to say:

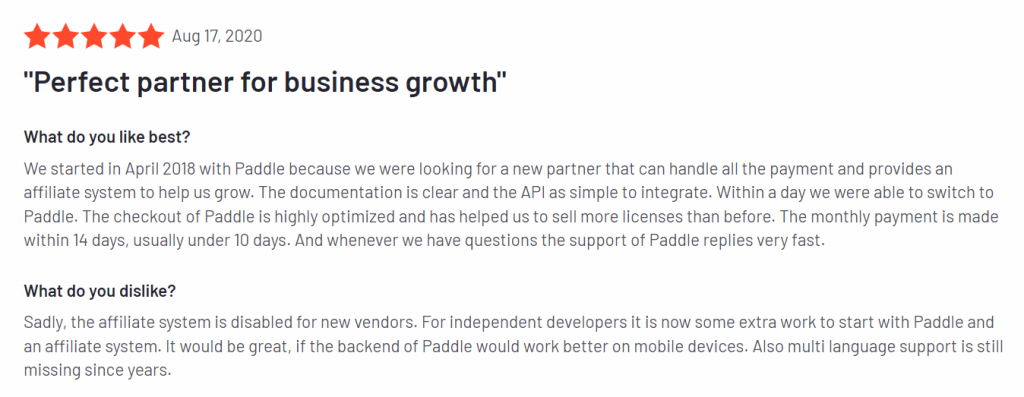

Paddle

Paddle at the moment has 4.5 stars on G2 with 145+ opinions.

Conclusion: FastSpring vs. Paddle vs. Stripe

When you’re promoting bodily services or products, FastSpring and Paddle should not an choice, making Stripe your best option out of the three choices mentioned right here. In case you are promoting digital merchandise, Stripe will not be your best option since you’ll be by yourself to construct out an entire fee resolution (which is expensive and time-consuming).

FastSpring has been serving SaaS companies for twice so long as Paddle and gives extra options and capabilities. FastSpring can also be higher ready to assist B2B corporations.

When you suppose FastSpring could possibly be the precise fee resolution for your small business, attain out to our workforce or arrange a free account.