Cautious scrutiny of your retirement plans requires you to consider annuities to steadiness your funding portfolio. Annuities stay dependable funding automobiles to generate a assured revenue post-retirement. Meticulously deliberate annuities typically replicate month-to-month paychecks that mirror within the type of wage amidst rising rates of interest.

The place Will I Begin With My Annuities?

Properly, you is likely to be in a dilemma about when to start out your annuities. Excellent timing ensures that you simply profit from the market circumstances. If you happen to plan to foretell the annuity charges sooner or later, it pays to start out investing on the proper time.

Including to all of the monetary dilemmas — the FED retains altering the rates of interest. So, what does growing rates of interest imply for annuities? We’ve got comprehensively coated the affect of climbing rates of interest for annuities on this article. Having this information will assist you plan your investments and maximize your returns.

Various kinds of annuities within the US

Earlier than leaping to the rate of interest affect on annuities, first, allow us to study the varieties of annuities you’ll be able to spend money on the US.

1. Quick annuities

Quick annuities assure funds to the investor inside the first 12 months. You can too get custom-made, assured revenue. As an example, you pay $200,000 as a single premium to your insurer. As per the settlement, the insurer pays you $5,000 per 30 days for a set interval afterward. The rates of interest and market circumstances decide the payout quantity.

Whereas deciding the kind of annuities, it is crucial to contemplate your age. In any other case, calculating your estimated necessities for retirement financial savings seems to be difficult. Buying rapid annuities assist assure a lifetime payout, no matter your age.

Nonetheless, the investor could be buying and selling liquidity to warrant a set revenue. Throughout emergencies, you will not have entry to this fund.

The prime profit of buying rapid annuities is that you simply get to know precisely how a lot you’ll obtain after your retirement.

2. Deferred annuities

By way of deferred annuities, you’ll be able to obtain assured revenue sooner or later. This could be a month-to-month influx of money or lump sum revenue. It’s worthwhile to pay month-to-month premiums or a lump sum quantity. Primarily based on the kind of funding you chose, the insurer will make investments the quantity persistently as per the contractual settlement. With deferred annuities, you’ll be able to develop the principal considerably. These investments additionally deliver you the chance to avoid wasting taxes.

3. Mounted annuities

If you happen to aren’t prepared to tackle increased danger, go for fastened facilities. As per the settlement, your insurer pays you a set charge of curiosity in your funding, which is assured. You’re going to obtain the payouts by an agreed time interval. As soon as the contract interval expires, you’ll be able to renew or annuitize your contract.

Moreover, one may also get the invested {dollars} transferred into a unique retirement account or annuity contract. Because the rate of interest is fastened, market volatility will not have an effect on your returns.

4. Variable annuities

A variable annuity refers to a contract the place the worth is predicated on how the underlying sub-accounts carry out. That is completely different from fastened annuities that supply a assured return. Nonetheless, you get to benefit from the scope of maximizing your returns by investing in a variable annuity. Nonetheless, these investments are usually riskier, as the worth of the sub-accounts would possibly fall, equivalent to opposed market performances.

Variable annuities maintain the best revenue potential. These annuity contracts are tax-deferred, enabling the investor to channel funds into sub-contracts. That is much like your investments in a 401 (ok). These sub-accounts assist to keep up the expansion trajectory of your annuity.

At occasions, these annuities will help you beat inflation. The sub-accounts, similar to mutual funds, are topic to market efficiency and danger. Moreover, you will get an revenue rider or a loss of life profit rider with variable annuities.

What makes timing essential for investing in annuities?

Usually, the sale of annuities tends to shoot up with rising rates of interest. It’s because individuals could be fascinated with discovering a secure place to park their funds whereas incomes a good return. For higher returns throughout retirement days, beginning your annuities is essential when rates of interest stay excessive.

Alternatively, the gross sales of annuities dip with low-interest charges. Individuals really feel the returns will not be too good throughout retirement. Naturally, they chorus from buying annuities when rates of interest are low.

Now that the rates of interest are hovering, persons are eager to buy annuities. Even when your office retirement plan or 401(ok) is operating dry, the revenue from the annuity will turn out to be useful. Amidst a risky market and growing rates of interest, this could be a good time to buy your annuities.

Annuities warrant a constant stream of month-to-month money influx

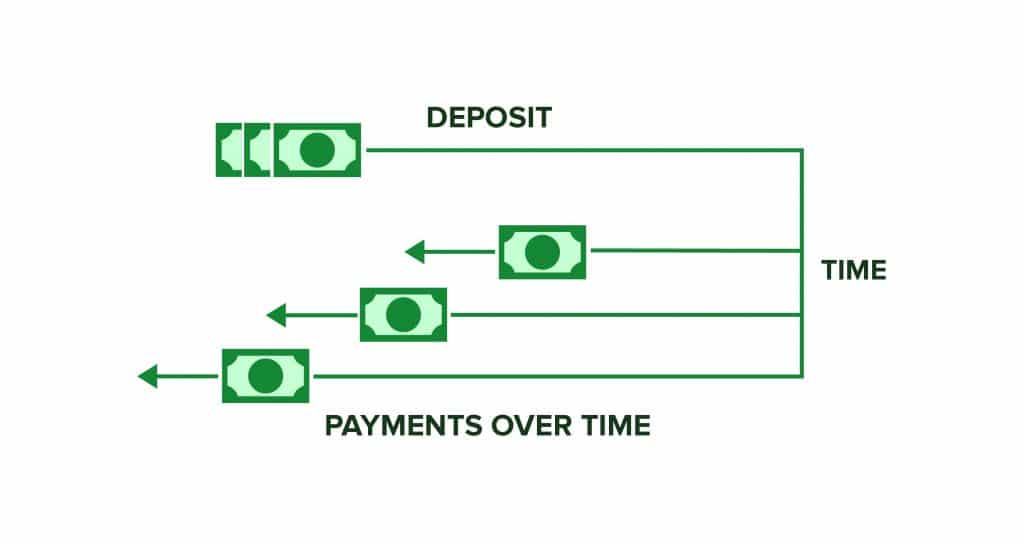

Annuities are designed to supply a constant month-to-month stream of revenue. That is much like your pensions and social safety. Whereas you’ll come throughout several types of annuities within the US monetary market, the core idea stays the identical. You pay premiums or make investments your funds with an insurer. The insurer, then again, retains paying a daily quantity of funds for the remainder of your life as per the settlement.

Since 2022, the common payouts from annuities have proven greater than a 13% increment for girls and 11% for males. This statistic is predicated on the information of a 65-year-old girl and a 70-year-old man who invested a $100,000 lump sum in annuities. As per CANNEX, the common sum insurers provided on the finish of April 2022 was $616, whereas it was $553 at the start of the 12 months. In 2023, the rates of interest have additional elevated, which may translate into increased annuity payouts.

Understanding the fundamentals of returns by annuities

Whether or not you go for a variable or fastened annuity for financial advantages, the issuer invests a large chunk of the property in fixed-income debt securities, bonds, index factors, or funding funds. Subsequently, the efficiency of debt securities largely determines the returns you acquire by annuities.

Whereas coping with bond issuers, the issuer of the annuity receives comparatively increased charges. The crediting charge, or the speed at which the annuity issuer pays to the annuity holder, is barely low. This distinction is known as “unfold.’

The commerce teams and regulators within the US often categorize the asset reporting for annuity merchandise and life insurance coverage collectively. In response to the Fed, annuity and life issuers maintain property value $9.8 trillion. This contains debt securities value $4.4 trillion. In 2021, life insurers boosted their bond holdings in debt securities by $141 billion.

In 2023, if life insurers make investments round $200 billion in bonds, it might lead to an increment of 1.9% within the new cash charge of the insurers. This can lead to an increment of $3.8 billion in a single 12 months by way of curiosity that the life insurers and their purchasers obtain.

Understanding the distribution of crediting charges and annuity unfold

- In response to S&P, listed annuity issuers assure that holders would obtain round a 3% to 4% common crediting charge.

- In December 2020, Moody’s Buyers Service said 9 life insurance coverage firms within the US that had been encountering unfold compression issues assured charges between 4% and 5.5%.

- In 2021, American Fairness said that their combination price of cash was 1.55%.

- Lincoln Monetary said that the common rate of interest at which it credited annuity contract holders was 1.93%.

In June 2021, the Nationwide Affiliation of Insurance coverage Commissioners declared that the general common unfold of life insurers between the online funding portfolio yield and their promised charge to purchasers dropped from 1.8% in 2007 to 0.63% in 2020. The mixture funding unfold of American Fairness in 2021 was 2.18%, whereas it was 1.43% for Lincoln Monetary.

How do increased rates of interest translate into increased annuity payouts?

As an investor, it pays to know the elements on which annuity payouts are calculated. Insurers think about the shopper’s life expectancy and rates of interest as two of the prime determinants of payouts.

Amidst the pandemic, the Federal Reserve drastically diminished the rates of interest to spice up the US financial system. Nonetheless, throughout its latest conferences, the Central Financial institution has been compelled to extend the rates of interest because of excessive inflation. The charges are additional anticipated to rise within the present 12 months.

Now, bonds proceed to be the cornerstone of the annuity portfolios of insurance coverage firms. With hovering rates of interest, they’ll generate a better return on new bonds. Naturally, they cross on the profit to their purchasers, and also you get to savor a better month-to-month money influx.

Once more, sure annuities, similar to multi-year assured annuities, serve like your financial savings account. On the finish of the time period, chances are you’ll determine to transform it right into a stream of normal month-to-month revenue.

The rate of interest for a five-year multi-year assured annuity on the finish of 2021 was 1.95%. Round Might 2022, it considerably rose to 2.9%. In 2023, the charges are additional prone to improve.

Naturally, buyers are eager to buy annuities in order that they’ll profit from increased returns. Though the charges differ from one insurer to the subsequent, they’ll nonetheless capitalize on the advantages. Earlier than investing, it pays to scrutinize the monetary power ranking of the insurers.

Normally, you’d discover monetary companies like Moody’s, Fitch Scores, A.M. Finest Firm, or S&P International Scores attributing these scores. A excessive ranking implies that the insurer would have the ability to generate extra revenue for you within the years to come back.

Why is the US annuity market rising?

Within the first quarter of 2022, fastened annuity gross sales within the US had been recorded at $35.2 million. This marks a 14% Y-o-Y progress. At the moment, the whole annuity gross sales had been up by 4%, at $63.6 million. By the tip of 2022, the worth was $310.6 billion, up by 22% in comparison with 2021.

This increment in annuity gross sales corresponds with the rise of rates of interest. Evidently, the correlation explains that extra persons are buying annuities because the rates of interest preserve growing. Their expectation of a better-guaranteed return within the coming years has been driving the US annuity market.

In 2023, the rates of interest are anticipated to rise additional, which might enhance the purchasers’ expectations. It stays to be seen what awaits the market within the remaining quarters of 2023.

Why do you have to purchase fastened annuities with rates of interest climbing?

Because the rates of interest preserve rising, Individuals are bracing to take a position extra in annuities. Let’s consider the affect of accelerating rates of interest on debtors and buyers.

In case you might be borrowing cash, this would not be a good time as you’d find yourself paying extra on curiosity. As an example, householders must pay increased on their mortgages all through their tenure.

Now, if you’re having fun with a money influx by an instrument influenced by mortgaged charges, you’d be on the gaining finish. To benefit from the market circumstances, it might be a logical resolution to spend money on a set annuity. Because the rates of interest are growing, you’ll be able to lock the deal at a excessive charge all through the time period. Even when the Federal Reserve cuts the rate of interest after a number of months, the present charge could be relevant to you.

Insurance coverage firms within the US situation these annuities. The curiosity that these insurers earn by their pursuits determines the pay to their purchasers. Subsequently, a better rate of interest would translate into increased fee for you throughout the contract’s dispersal interval.

Let’s take a case that will help you perceive the circumstances higher. In case a 70-year-old girl invested $1 million as a premium to buy a life-only revenue annuity on twenty first December 2021, the annuity fee could be round $67,204. Nonetheless, the identical product may have fetched her $71,926 had she invested the identical quantity on twenty second March 2022. The distinction in fee is 7%, which could be even increased because the charges preserve growing in 2023.

Endnote

Annuities proceed to be a core share of a well-balanced funding portfolio. If you’re planning your retirement financial savings, it pays to contemplate the returns by annuities. Now that you recognize why timing issues whereas beginning your annuities, this could be a good time to take a position.

With the rates of interest rising, annuity consumers can lock the speed and revel in assured returns after the tenure. Moreover, the Federal Reserve is prone to additional increase the rates of interest in 2023. Even when you accept a variable annuity, the climbing rates of interest promise superior returns.

The put up What Climbing Curiosity Charges Imply for Annuities? appeared first on Due.