Estimated learn time: 14 minutes, 47 seconds

Most Stripe options fall into considered one of two classes: (1) cost processors, or (2) a billing answer that covers cost processing and different features of billing similar to fraud detection, checkout, and extra.

For SaaS corporations, the best approach to handle all features of billing is to decide on an answer that acts as your Service provider of File (MoR). A billing answer that acts as your MoR offers you entry to a number of cost processors (which helps you to settle for extra cost strategies and is beneficial when accepting funds globally, as we clarify beneath) whereas taking up the legal responsibility of all transactions for you. A MoR additionally takes the lead on chargebacks, tax audits, authorized compliance, and extra.

When promoting bodily items and companies (on-line or in individual), varied Stripe options constructed for bodily items funds (like Amazon pay, Sq., and many others.) can present cost processing, order success, financing choices, and extra. (It’s price noting that almost all of those options will also be utilized by SaaS corporations, nonetheless, none of them is an entire cost answer.)

On this information, we examine eight of the perfect Stripe options in every of those classes. Since our experience is in offering MoR companies to SaaS corporations, we’ll begin with an in-depth assessment of our answer, FastSpring.

Desk of Contents

- MoRs for SaaS Firms

- FastSpring: Worldwide Fee Resolution for SaaS

- Paddle: Fee Infrastructure Platform

- Verifone: Previously 2checkout

- Billing Software program for Promoting Bodily Items and Companies

- Sq.: Fashionable Fee Platform for Startups

- PayPal for Enterprise: Obtainable on Main eCommerce Platforms

- Authorize.web: For Retailers and Small Companies

- Adyen: Strong Monetary Expertise Platform

- Amazon: Fee Service and Order Achievement

All-in-one Fee Options for SaaS Firms (MoRs)

Most corporations utilizing Stripe (or one thing much like Stripe) know that Stripe does rather more than simply cost processing however that there are challenges to creating the system be just right for you. It might probably require tons of add-ons and extra charges, and a few of the options are restricted.

For instance, Stripe advertises subscription administration options, nonetheless, many corporations find yourself integrating with one other service like Chargebee or Recurly to get the subscription administration options they want.

Most of the time, SaaS corporations find yourself with a cost tech stack of over a dozen instruments for:

- Calculating worldwide taxes.

- Extra subscription administration options.

- Fraud safety.

- Dealing with chargebacks.

- Checkout.

- Getting larger authorization charges in different nations.

- And extra.

Making all of it work collectively places a large pressure on the event staff.

Lastly, you’ll want to keep up a big staff of tax and authorized consultants to keep up world compliance (as a result of options like Stripe don’t assist with any legalities). Whereas it’s true that, traditionally, SaaS and ecommerce corporations didn’t at all times should pay VAT or gross sales tax, that’s now not the case. In the event you don’t collect and remit the correct amount of tax in every jurisdiction that you just promote in, you could possibly face hefty fines or get banned from promoting in that area sooner or later.

Selecting a billing answer that additionally acts as your MoR solves all of those issues.

A MoR takes care of the complete SaaS billing course of for you, together with amassing and remitting native and worldwide taxes (similar to VAT and native gross sales tax), staying compliant with native legal guidelines and rules, cost processing, chargebacks, and rather more.

FastSpring: Worldwide Fee Resolution for SaaS

FastSpring has been performing as a MoR for world software program corporations for practically 20 years, so we all know what it takes to increase globally virtually in a single day. Listed here are some examples of how FastSpring helped different SaaS corporations increase globally and improve income:

- Mailbird achieved over 100% progress by switching to FastSpring. They beforehand experimented with platforms like Stripe and PayPal. Learn the Mailbird case research right here.

- NotePlan elevated conversions by over 60% by switching from Paddle to FastSpring. FastSpring supplied a number of checkout, localization, and coupon options that NotePlan wanted. Plus, our staff offered personalised suggestions for methods NotePlan may enhance their checkout expertise to optimize conversions. Learn the NotePlan case research right here.

- SocialBee doubled its month-to-month recurring income and managed tax compliance by switching from Braintree to FastSpring. Learn the SocialBee case research right here.

Subsequent, we’ll take a deep dive into just a few of FastSpring’s SaaS billing options.

Notice: The next options are additionally supplied to corporations promoting digital merchandise and downloadable software program.

Leverage A number of Fee Processors to Improve Income

Many SaaS corporations and founding groups initially suppose they simply want one cost processor to just accept funds. Nonetheless, most SaaS corporations ultimately find yourself needing extra so as to:

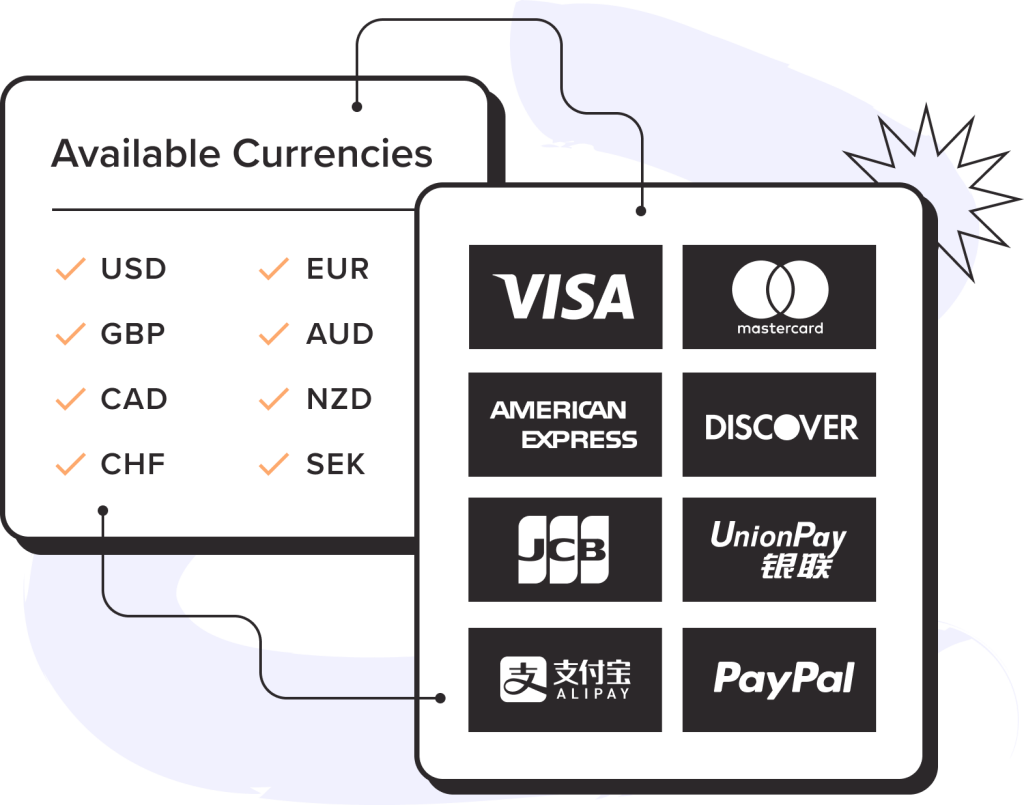

- Settle for extra cost strategies: Prospects usually tend to full a purchase order if they will use their most popular cost methodology. Nonetheless, not each cost processor helps the identical listing of cost strategies. Working with a number of cost processors helps you to settle for extra cost strategies and, due to this fact, improve income.

- Improve authorization charges for worldwide transactions: Card networks usually tend to authorize transactions when the cost processor has a authorized entity in the identical location. Some cost processors will set up a authorized entity in a number of places, nonetheless, most corporations nonetheless have to work with a number of cost processors with a purpose to course of all funds regionally.

- Settle for funds from extra nations: Some cost processors solely assist funds from choose nations or areas. Working with a number of cost processors helps you to attain clients in additional places.

Working with a number of cost processors also can clear up connectivity points or system failures. If one cost processor is experiencing a community failure, you may reroute the transaction to a cost processor that’s absolutely operational.

With FastSpring, you’ll be supported by a number of cost processors focusing on world transactions and settle for the most typical cost strategies world wide — together with PayPal and Amazon Pay.

Click on right here to see the total listing of cost strategies accepted by FastSpring.

Relying on the situation of the customer, FastSpring robotically directs the transaction to the cost processor with the very best authorization charges in that area. Then, if a transaction fails, we robotically retry the transaction utilizing a secondary processor.

Notice: You even have the choice to dam transactions from sure areas or restrict merchandise in every area.

Associated: Prime 10 Worldwide Fee Gateways: An In-Depth Information

Forestall Fraudulent Transactions with out Blocking Legitimate Transactions

The appropriate fraud safety may also help you improve authorization charges, lower chargebacks, and shield your organization from assaults. Nonetheless, if respectable transactions get marked as fraud, you’ll lose income.

FastSpring companions with Sift for superior danger evaluation and fraud safety. Sift makes use of machine studying and AI to research thousands and thousands of worldwide transactions every month to determine dangerous transactions with larger accuracy. This implies your fraud safety is consistently evolving to supply higher safety and enhance approval charges.

FastSpring also can block transactions from nations and jurisdictions the place corporations are presently not allowed to do enterprise.

If considered one of your clients does provoke a chargeback, or there’s a problem with fraud, FastSpring takes the result in resolve it for you.

Keep away from Excessive Fines and Penalties by Letting FastSpring Deal with Native Authorized Compliance for You

Even when all respectable transactions undergo, you could possibly face hefty fines or be prevented from transacting in that area if the transactions don’t adjust to native legal guidelines and rules. For instance, the Reserve Financial institution of India limits automated recurring funds to ₹15,000 INR.

Most corporations want a full compliance division of authorized professionals to maintain updated with all of the legal guidelines and rules of every jurisdiction they do enterprise in.

You can even be fined or face penalties in case you don’t file consumption tax. SaaS corporations didn’t at all times should pay tax, however tax rules for digital gross sales are altering and being more and more enforced.

Firms that use Stripe (or one other level answer) should deal with tax on their very own. Whereas Stripe will assist collect gross sales tax, you’ll want different software program to gather VAT, GST, and different types of consumption tax. Plus, you’ll want a employees of tax consultants to remit the tax on the finish of every tax interval.

FastSpring relieves you of those burdens by:

- Accumulating all consumption tax (together with GST, VAT, SST, and many others.) and remitting it on the acceptable time for you.

- Taking the lead on authorized compliance (together with audits).

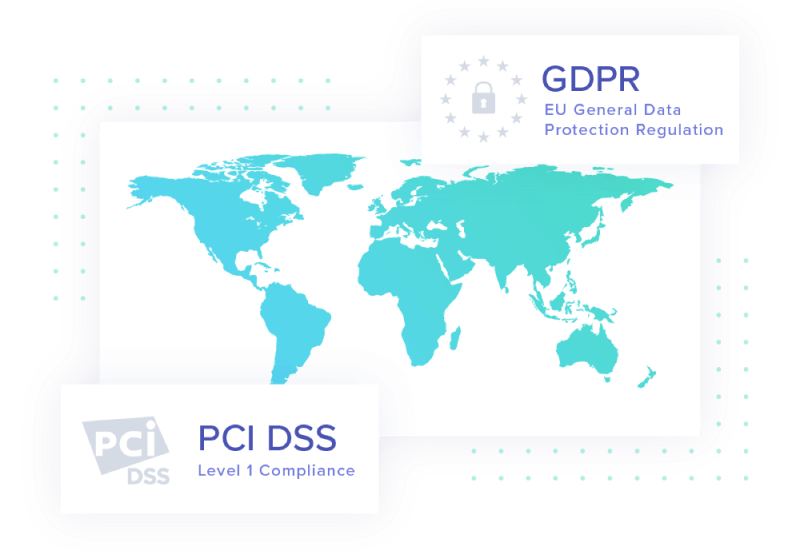

FastSpring is absolutely compliant with the EU Common Information Safety Regulation (GDPR) and the California Shopper Privateness Act (CCPA). Moreover, we renew our degree one certification — which is the very best degree potential — with the Fee Card Trade Information Safety Customary (PCI DSS) yearly.

Handle Every thing from Checkout to Subscriptions in One Platform

As a substitute of needing to construct a cost stack of over a dozen totally different options that will help you handle subscriptions, checkout experiences, reporting, analytics, and extra, FastSpring lets corporations handle all features of SaaS billing straight from their FastSpring dashboard.

Under is a short overview of those options. For a whole listing of options (together with digital invoicing and interactive quotes) go to this web page.

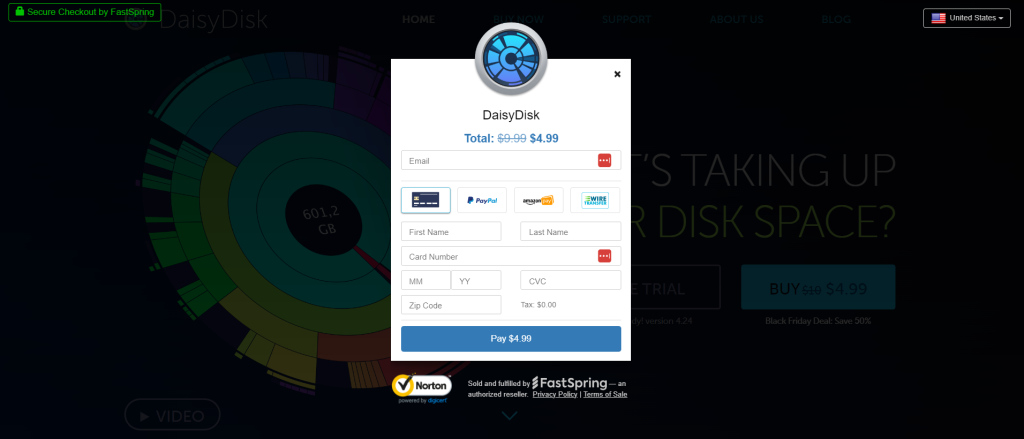

Customized, Localized Checkout

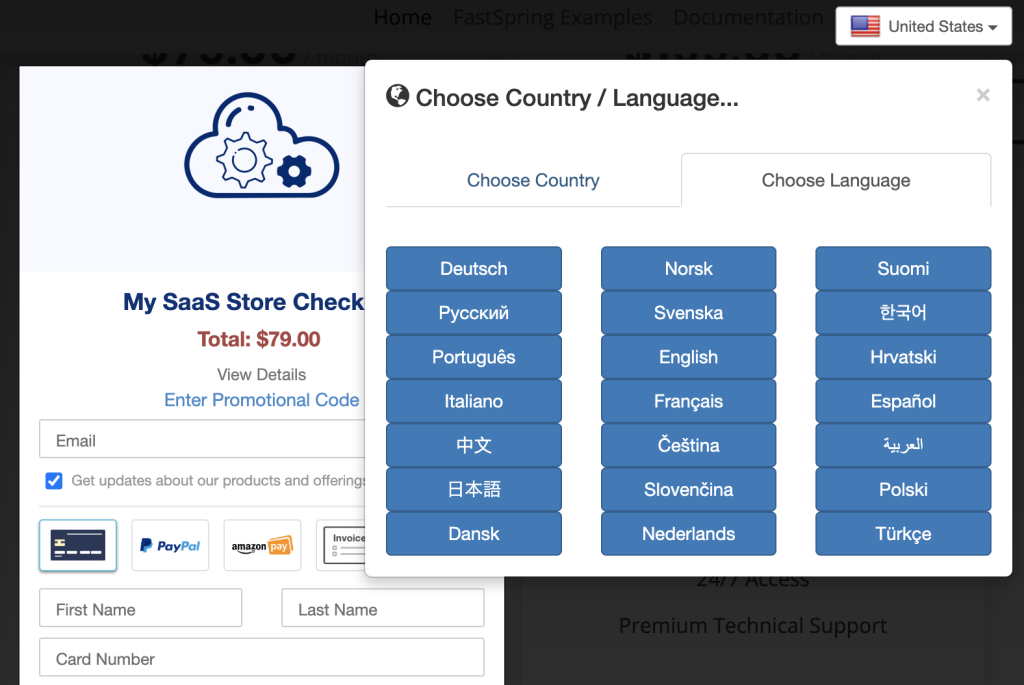

FastSpring offers you full management over your checkout course of with our Retailer Builder Library. You’ll be able to customise any facet of checkout and our staff will supply personalised assist alongside the way in which. We additionally supply pre-built experiences. With minimal code, you may embed checkout right into a webpage or have a pop-up checkout. Or, if you wish to outsource your entire checkout course of, you may select the net storefront choice the place your clients shall be redirected to a FastSpring web site to finish the acquisition. You’ll be able to customise the storefront to match the visible branding of your web site.

Whichever checkout expertise you select, FastSpring helps you to translate checkout into native languages and convert costs to native currencies.

Associated: Worldwide Recurring Funds (How We Deal with It for You)

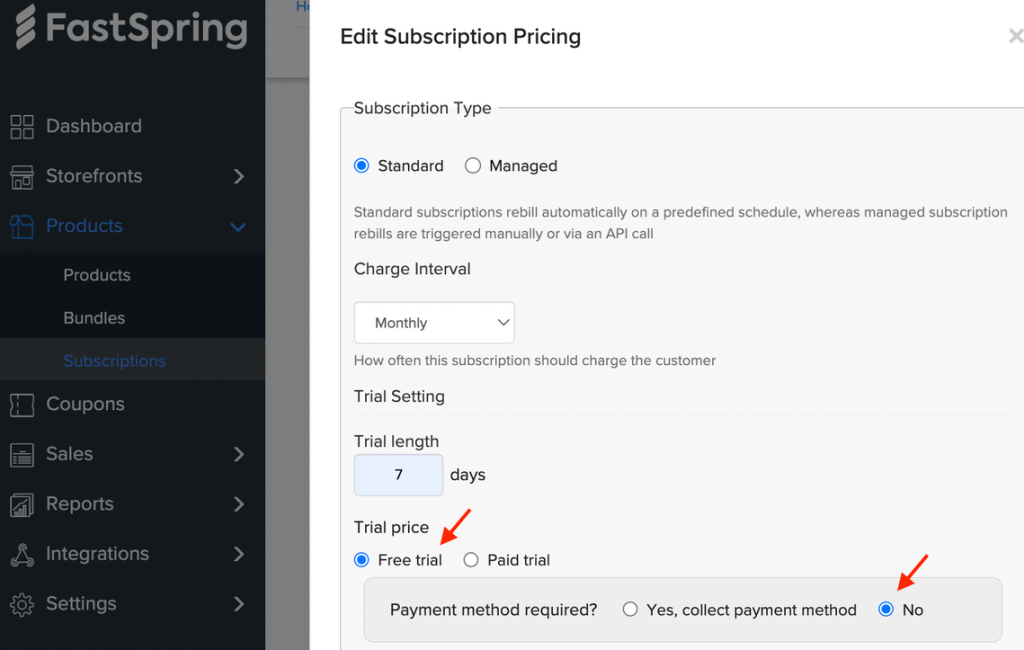

Subscription Administration

FastSpring helps you to create quite a lot of customized trial and recurring billing fashions with out code. You can even use FastSpring’s API and webhooks library to construct extra complicated subscription logic and integrations.

If you wish to see how FastSpring compares to Chargebee, learn this text.

Dunning Administration

FastSpring handles all failed funds and buyer notifications for you — merely select the way you need it dealt with and we handle the remainder. Just a few choices you’ve are to:

- Ship proactive notifications to clients (e.g., ‘your bank card is expiring quickly’).

- Ship A number of follow-up notifications (e.g., two, 5, seven, fourteen, and twenty-one days after their cost methodology fails).

- Proceed (or pause) the service till the final notification has been despatched out.

- Pause (or cancel) the service as soon as all notifications have been despatched out and the cost continues to be getting declined.

With FastSpring, your clients may also have entry to an intuitive self-serve portal the place they will replace cost info and handle their subscription plan.

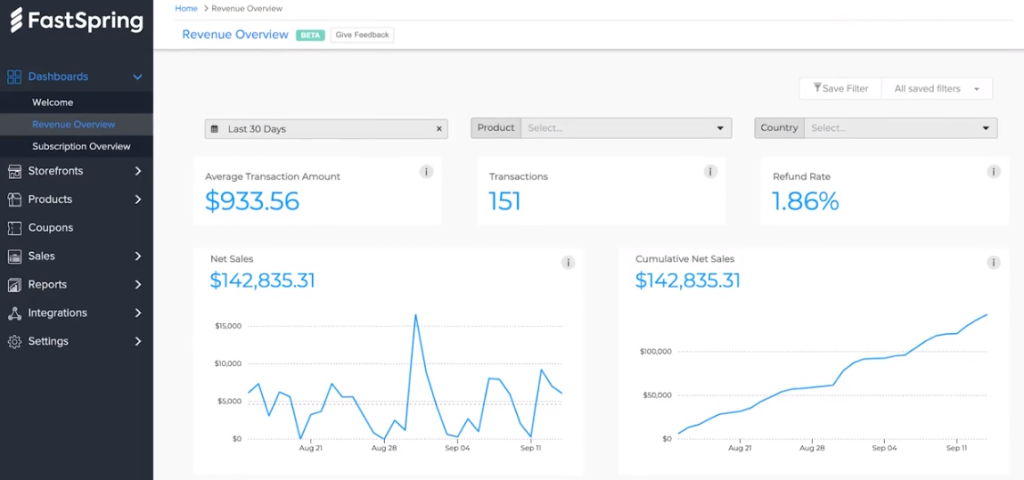

Reporting and Analytics

Many SaaS corporations utilizing Stripe find yourself including a reporting and buyer analytics instrument to offer them perception into stats like MRR, churn charge, new clients by product kind or geography, and extra.

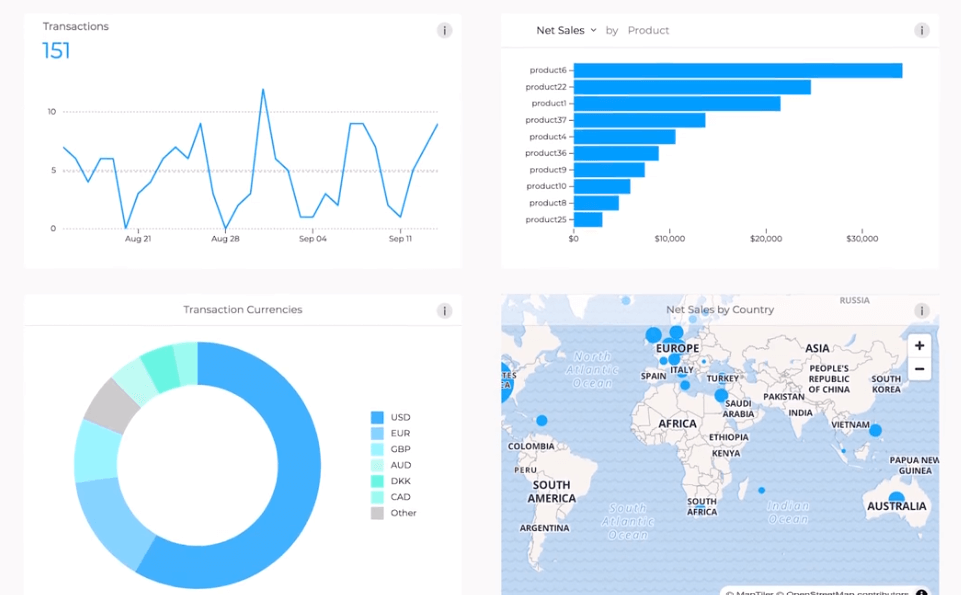

FastSpring, then again, has a sturdy reporting and analytics instrument constructed into your dashboard the place you may view key efficiency indicators (KPI) to your buyer base and your subscription fashions. You’ll be able to view stories to know:

- How every product contributes to your backside line.

- What coupons or promotions are working.

- Which subscription fashions generate essentially the most income.

- The place your clients are situated.

- And rather more.

Each report could be custom-made and saved for straightforward entry afterward. You can even export and share stories as a CSV, PNG, or XLSX spreadsheet.

For a whole listing of options — together with Digital Invoicing and Interactive Quotes — go to our web site.

Flat-Charge Payment with out Hidden Prices

Most cost processors (like Stripe) sometimes cost a low processing payment, nonetheless, they’ll cost additional for options like subscription administration, extra cost methodology assist, and tax assortment. Plus, you’ll should pay for any extra software program wanted for a whole billing answer and the employees to handle your entire course of. For many corporations, this finally ends up being an costly path to take.

Then again, FastSpring manages your complete SaaS billing course of for one flat-rate transaction payment. No add-on charges. No transition charges. No expenses till a transaction takes place.

Attain out to our staff to seek out the speed that works for you. You can even preview FastSpring options by organising a free account.

Paddle: Fee Infrastructure Platform

Paddle acts as a MoR for SaaS corporations targeted on B2C transactions with the flexibility to ship single-product transactions. Paddle has options similar to:

- Safe checkout.

- Recurring billing administration.

- A strong funds toolkit.

- Fraud safety.

- Transaction and subscription reporting. (With their current acquisition of ProfitWell, they give the impression of being to ship SaaS reporting integrations sooner or later.)

- Invoicing. (This function continues to be in beta, so it is probably not the only option for B2B corporations.)

- And extra.

Verifone: Previously 2checkout

Verifone will act as your MoR or simply course of funds. This offers them the flexibleness to assist small to medium-sized corporations in several industries (e.g., retail and hospitality) providing each in-person and on-line items or companies.

Verifone functionalities embody:

- Built-in POS.

- Kiosks.

- Crypto cost processing.

- Machine diagnostics.

- Hosted checkout.

- And extra.

With practically 20 years of expertise serving worldwide software program corporations, FastSpring is likely one of the longest-standing MoRs for SaaS corporations. Use our experience to assist develop your enterprise rapidly. To study extra, join a free account or request a demo immediately.

Billing Software program for Promoting Bodily Items and Companies

Whereas SaaS corporations can use virtually any billing answer to promote their product (though some shall be simpler than others), not each answer shall be efficient for corporations promoting bodily items or companies. Firms promoting bodily items and companies want options that may handle on-line and in-person gross sales.

When promoting bodily items or companies, most corporations find yourself utilizing two or extra totally different software program to construct an entire billing answer. Nonetheless, there are methods to reduce what number of totally different software program you want and the way a lot it can price you. The most effective place to begin is to fastidiously take into account your present wants (e.g., are you promoting in-person and on-line?) and plan to your future wants (e.g., will you wish to begin promoting on-line sooner or later?).

Then, you may consider every billing answer by asking just a few key questions:

- What number of features of billing does the software program cowl? Is every providing really enough to your present wants (e.g., perhaps they provide a subscription billing answer however they don’t assist the mannequin you want)? Do the options depart room to your firm to develop?

- Will you get all options for one worth or will it’s a must to pay additional for the options you want? Will the worth be sustainable long-term, as your organization grows?

- How simple will or not it’s to combine the software program with different software program?

- Is the software program user-friendly?

Subsequent, we cowl 5 Stripe opponents for corporations promoting bodily items and companies that will help you get began together with your search.

Sq.: Fashionable Fee Platform for Startups

Sq. is a well-liked point-of-sale answer for corporations of all sizes. With Sq., you may settle for funds out of your on-line retailer, in-person, or by way of social media. Past cost processing, Sq. additionally gives options for:

- Digital terminals (so you may settle for bank card funds utilizing your pc).

- Advertising.

- Organizing buyer contacts.

- Banking (together with service provider accounts, financial savings accounts, and loans).

- Employees administration (together with payroll, break day, and many others.).

- And extra.

PayPal for Enterprise: Obtainable on Main eCommerce Platforms

PayPal is a well known ewallet for private on-line funds, nonetheless, in addition they supply cost choices for companies of all sizes. PayPal helps debit card and bank card processing in-store or out of your on-line enterprise.

(SaaS corporations utilizing FastSpring also can course of funds utilizing PayPal.)

PayPal for Enterprise additionally contains:

- Enterprise financing.

- Donation instruments.

- Constructed-in integrations with main ecommerce purchasing carts (e.g., Shopify).

- Chargeback and refund consulting companies.

- A cellular app.

- Mass payouts.

- And extra.

Notice: PayPal additionally has a cost processor particularly for SaaS referred to as Braintree.

Authorize.web: For Retailers and Small Companies

Authorize.web (a Visa answer) is a cost service supplier that helps cellular funds, telephone funds, and ACH. In addition they present a card reader for in-person funds and assist on-line purchases.

Different options supplied by Authorize.web embody:

- 24/7, reside buyer assist.

- Buyer administration options to enhance ease of use.

- Digital invoicing.

- Recurring cost instrument.

- Superior fraud detection suite (AFDS).

- And extra.

Adyen: Strong Monetary Expertise Platform

Adyen is a monetary know-how platform with a concentrate on scalable progress. Along with cost processing, Adyen gives options similar to:

- Digital and bodily card creation.

- Instruments to optimize site visitors in real-time.

- Superior fraud algorithm.

- Cross-channel gross sales assist.

- Enterprise financial institution accounts to your customers.

- And extra.

Amazon Pay: Fee Service and Order Achievement

Amazon Pay lets your clients use the cost info already saved of their Amazon account in your web site. Amazon Pay can be utilized as a stand-alone cost answer with out changing into an Amazon service provider. Though you may simply use Amazon Pay by yourself web site and grow to be an Amazon service provider (which provides you the choice for success by Amazon).

Amazon Pay contains:

- Optimized checkouts modeled after Amazon’s personal checkout.

- Co-marketing campaigns.

- Self-service reporting dashboard.

- Simple integration instruments.

- And extra.

Notice: With FastSpring, your clients will pay utilizing Amazon Pay and lots of different cost strategies.

FastSpring helps you to handle each facet of worldwide SaaS cost from one platform — with out managing tons of various software program options. We tackle taxes, regulation compliance, and rather more for you. Join a free account or request a demo immediately.