Prefer it or not, monetary pitfalls are part of life. Monetary errors can occur even with the very best of intentions. Nevertheless, it’s not all about making errors. It’s additionally in regards to the alternatives you don’t make the most of.

Even so, it’s by no means too late to study from these errors, and it’s by no means too quickly to keep away from them. With that stated, on this article, we’ll have a look at 25 methods you’re killing your financial savings and keep away from them.

High Methods You’re Killing Your Financial savings

1. Delaying monetary planning.

All of us have been responsible of laying aside issues till one other day, whether or not it was beginning a exercise routine or saving cash. The issue with the “I’ll try this later” philosophy? It’s possible you’ll by no means observe by means of — regardless of your greatest intentions.

Moreover, you might have missed some alternatives to plan your monetary future. And, even worse, you’re lacking out on the facility of compounding.

Take into account, for instance, investing $1,000 and incomes a 7% return yearly. Your account can be valued at $1,070 after yr one in the event you earned $70. Your account can be value $1,144.90 in yr two after incomes $74.90. By yr three, you’ll have earned $80.14, bringing your complete to $1,225.04.

In time, this could snowball and doubtlessly add as much as a big quantity in case your account continues to develop on this method.

Merely put, laying aside monetary chores solely contributes to an ever-growing to-do record. Delaying time-sensitive duties like paying off debt or planning for retirement may value you extra in the long term.

How will you keep away from procrastination? Make managing your funds simpler by breaking them down into manageable chunks. Whilst you don’t have to arrange your funds in a single day, ignoring your to-do record gained’t make it disappear. Take into account setting apart time as soon as per week or as soon as a month to observe your funds and attain essential duties.

2. Frivolous and extreme spending.

Dropping one greenback at a time can lead to plenty of monetary losses. It’s possible you’ll not suppose it’s an enormous deal to order a double-mocha cappuccino, exit to dinner, or watch a pay-per-view film. However it provides up.

Take into account this. People spend a median of $2,375 per yr on eating and takeout. These funds might be used to repay a bank card debt or pad your financial savings.

It’s crucial to keep away from this error if you’re experiencing monetary hardship. When a couple of {dollars} separate you from foreclosures or chapter, each greenback counts. In case you aren’t in that unhealthy of monetary form, think about eating out or getting takeout much less typically. Whenever you do, search for offers or have lunch as a substitute of dinner.

3. Dwelling past your means.

Chances are high you’re residing above your means in the event you’re sweating over cash. To make certain although, check out these 5 indicators that you simply’re heading for bother.

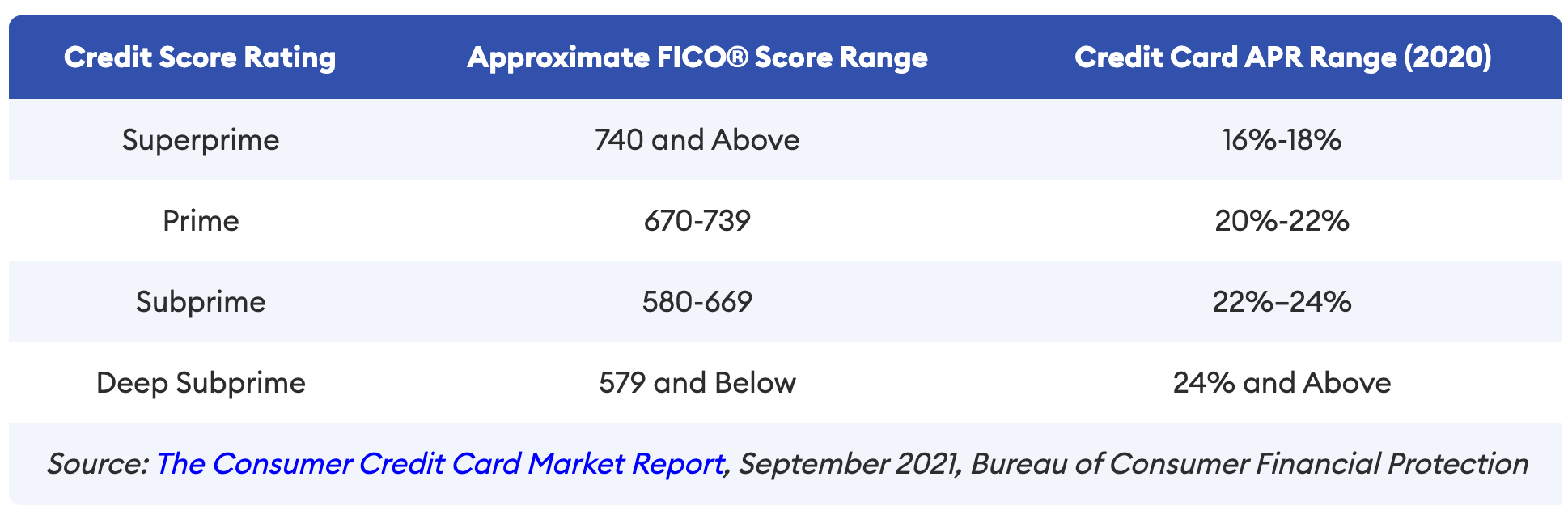

- Your credit score rating is 579 or decrease. On this case, further credit score is tough to get at an inexpensive rate of interest as that is beneath the common.

- The amount of cash you save is lower than 5% of your gross revenue. It’s seemingly that you simply’re over your head if so. An individual who spends greater than she or he earns is certainly in over their head.

- You will have a rising bank card steadiness. It is rather seemingly that you’ll find yourself in debt in the event you solely pay the minimal every month in your bank card balances or in the event you solely contribute a small quantity to the principal steadiness.

- You spend greater than 28% of your revenue on housing. Decide how a lot of your month-to-month revenue goes towards mortgage funds, property taxes, and insurance coverage. It’s possible you’ll be overextending your self if it exceeds 28% of your gross revenue.

- You might be drowning in payments. It’s possible you’ll be overstretched in case your month-to-month revenue is sliced and diced to cowl dozens of pointless installment purchases.

Don’t mistake residing beneath your means for being a cheapskate or skipping out on life’s experiences. As a substitute, it “merely implies that you’re spending much less or equal than you’re making every month,” explains Deanna Ritchie in a earlier Due article. “Because of this, you aren’t placing your self into debt by residing off of plastic. And extra importantly, this can provide help to create a extra steady monetary future.”

“In fact, residing inside your means requires self-discipline and a bit sacrifice,” provides Deanna.

4. Lending family and friends cash who gained’t pay you again.

In fact, masking a buddy’s dinner could be very totally different from serving to to pay their hire. Even if in case you have the cash at the moment, you’re enjoying with fireplace if they’ve a poor monitor file in relation to managing their funds.

For instance, what in the event that they don’t pay you again and also you lose your job or have a medical bills? The money you had been imagined to have will run out. In case you can’t discover the cash from different sources, chances are you’ll be pressured to borrow it.

Serving to somebody out can take many kinds. It could be so simple as bringing them lunch till they’re steady or serving to them replace their résumés.

In accordance with Bankrate: 60 p.c of People have helped out a buddy or member of the family by lending money with the expectation of being paid again, whereas 17 p.c have lent their bank card and 21 p.c have co-signed for a monetary product like a mortgage or rental

5. Not having an emergency fund.

“An emergency fund pertains to the quantity put aside to take care of monetary safety,” explains Chris Porteous in a earlier Due article. “In essence, that is the portion of your financial savings that you need to solely spend for emergencies.”

This cash can be utilized for pressing bills throughout occasions of monetary hardship. By creating a security internet, you stop your self from withdrawing cash out of your major financial savings account. Because of this, you might be prevented from counting on pricey options similar to financial institution loans, payday loans, or bank cards. “Therefore, your retirement fund will stay untouched.”

Most emergency funds include liquid property. These are property which are simply convertible into money. With a view to cowl pressing bills, you need to have the means to take action. Some examples are your investments in monetary markets and your receivables from debtors. Even when earnings are inconsistent, they supply an prompt cushion to maintain you afloat.

“Whenever you construct an emergency fund, don’t save a substantial portion of your revenue straight away.” Chris provides. “Solely put aside the quantity that won’t harm your monetary progress since you may have fixed bills.” Nevertheless, be sure you manage to pay for to deal with future mishaps. This will likely embody unplanned hospitalizations, unannounced layoffs, and property injury.

6. Lack of a finances for every month.

Maybe the commonest cash mistake isn’t sticking to a finances. In truth, in accordance with a survey by mortgage servicing firm OppLoans, 73% of People don’t often adhere to a finances.

Why’s that regarding? We regularly burn holes in our pockets with little luxuries that we don’t even discover. These may embody health club memberships, nights out, and impulsive purchases. There’s nothing incorrect with making these purchases once in a while. It turns into problematic after they turn out to be a behavior and don’t match inside your month-to-month finances.

“Do you could monitor each single greenback coming out and in? Completely not,” says Aja Evans, a licensed psychological well being counselor who makes a speciality of monetary remedy. “A finances is for ensuring you may have a plan or perceive the place your cash goes.”

Together with the effort of monitoring bills, budgeting is “arduous for individuals psychologically,” as a result of they affiliate them with self-denial. Budgets aren’t nearly restrictions, Evans says. Moreover, you’ll be able to prioritize stuff you get pleasure from, like eating out or vacationing.

7. Laying aside retirement financial savings till later in life.

As Millennials and Gen Z staff enter the job market, they’re extra involved with paying off their pupil loans than saving for retirement. In spite of everything, within the early years of 1’s profession, 65 could seem distant. In the long term, nonetheless, cash saved early will develop right into a a lot bigger nest egg.

For instance, let’s say that begin contributing $2,000 yearly to an IRA with a 6 p.c annual return at age 25. At 65, your funding can be value $328,095 (40 x $2.000).

What in the event you began your $2,000 annual contribution at 30? After investing $70,000 (35 occasions $2,000), you’ll solely obtain $236,242.

General, the earlier you begin saving, the higher.

8. Insufficient insurance coverage protection.

Insurance coverage pays for contingencies as a result of individuals don’t need to spend cash on something with out a assure of return.

It’s attainable to smash your funds with out insurance coverage in the event you do not need sufficient money to cowl a big medical invoice, automotive accident, home fireplace, or theft. It’s a small value to pay for ample safety.

Conversely, paying for redundant or pointless insurance coverage protection can drain your checking account. You could possibly safe rental automotive insurance coverage by means of your bank card or auto insurance coverage, for instance.

9. Life-style inflation.

With a rise in revenue, you are inclined to spend extra in your way of life. Usually, you don’t even discover one of these waste of cash till it’s too late.

To be truthful, when you’ll be able to afford sure objects, it could be value spending extra on them. The long-term value of well-made garments is decrease than that of low cost ones, as an illustration.

You’ll be able to typically reside comfortably even while you make much less cash in the event you purchase issues and reside the best way you probably did while you made much less cash. It is not going to make you happier or improve your high quality of life in the event you improve your spending.

Spend your further revenue on issues you really want as a substitute of on fancier issues. Among the many prospects are saving extra, growing your retirement contributions, or paying off debt. If all that’s so as, think about shopping for an annuity.

With annuities, it can save you your cash tax-deferred till you obtain retirement revenue. You gained’t have to fret about outliving your retirement financial savings with them. As well as, they will present for your loved ones after you die or in your personal long-term care if the necessity arises.

10. Repaying the incorrect debt first.

When you may have pupil loans, a automotive cost, bank card debt, and a mortgage, it may be tough to know the place to start out. Regardless of this, monetary advisors warning you to prioritize paying off your money owed fastidiously.

It’s extra widespread for individuals to pay further on their mortgage, which has a 3% rate of interest. In distinction, they don’t pay high-interest charges on their pupil loans or automotive loans.

Everytime you plan to repay your debt, begin by writing down all of your balances and the rates of interest related to them. Debt with the very best rate of interest ought to be tackled first, similar to bank cards, earlier than transferring on to the debt with decrease rates of interest.

If you’re experiencing [credit card] debt, you could deal with it urgently, probably even delaying retirement contributions whilst you get your balances beneath management. Whenever you repay your money owed, you’ll not solely enhance your credit score rating, however additionally, you will have more cash to take a position and save. Specifically, that is true when the common bank card rate of interest is 23.77%, in accordance with Forbes Advisor.

11. Your free time isn’t getting used to earn cash.

Your checking account isn’t the one motive you need to generate profits in your free time. Slightly further revenue could be the distinction between attaining your long-term monetary objectives and never attaining them. As well as, it offers you the additional funds to deal with your self when it’s time.

Additionally, don’t suppose you’ll be able to simply generate profits on the facet of your pockets. You’ll be able to improve your profession prospects by having a facet hustle, which is able to impress potential employers as this could develop your abilities.

It doesn’t matter if it’s pet sitting, beginning your personal enterprise, promoting images on-line, or every other passive revenue concept, each little bit helps.

12. Shopping for new automobiles with out contemplating used automobiles.

A brand new automotive’s worth drops the minute you drive it off the lot. It differs from automotive mannequin, make, repairs, and different elements, however the depreciation fee of a brand new automotive could be as excessive as 20% (or much more) after one yr and attain round 40% after 5 years.

Because of this, used automobiles could also be a very good choice in the event you want new wheels. Depreciation has already been paid for by the earlier proprietor – not you. In case you promote your car after three to 6 years, you’ll achieve more cash than in the event you promote it after one to a few.

13. Utilizing house fairness as a piggy financial institution.

The act of refinancing and withdrawing money from your home means you might be gifting away possession to a different individual. In case you’re capable of decrease your fee or refinance and repay high-interest debt, refinancing would possibly make sense.

Alternatively, you’ll be able to open a house fairness line of credit score (HELOC). A HELOC, is a revolving credit score line secured by your house that can be utilized for giant bills or to consolidate higher-interest fee debt from different loans, similar to bank cards. Along with having a decrease rate of interest than another widespread varieties of loans, a HELOC might also be tax deductible.

14. Not diversifying your investments.

Within the occasion that your entire financial savings are invested in a single kind of funding and it performs poorly, you’ll lose cash. The perfect factor to do is to unfold your cash amongst a couple of totally different accounts. Your funding portfolios ought to be managed by the identical monetary planner or held in the identical blanket account – with various ranges of danger and reward.

Utilizing this technique, you’ll be able to develop your wealth whereas sustaining stability in lower-risk investments whereas capturing among the advantages of riskier investments.

15. Not paying your payments on time.

Late charges, broken credit score scores, and different unfavorable monetary penalties might outcome from falling behind or lacking invoice funds. Your credit score rating could be broken in the event you fail to satisfy your month-to-month obligations as effectively. In some circumstances, as little as two late funds can lead to a everlasting mark in your credit score report.

The simplest answer? Streamline the method of paying your month-to-month payments by establishing an computerized cost by means of your on-line checking account, brokerage account, or mutual fund.

Shopper Affairs studies that “Lower than a 3rd (32%) of respondents had been in a position to economize persistently, whereas simply over 1 / 4 (26%) had been capable of make investments. A couple of fifth stated their capability to afford payments worsened as a result of inflation.”

16. Lacking out in your employer matching contributions.

Do you max out your office retirement plan (401k, and so on)? Is your employer providing an identical contribution?

It applies particularly to you in the event you answered sure to each questions.

Why? It’s attainable that you’re lacking out on free cash. Furthermore, it might be free cash accumulating over a 30-year interval.

There are various varieties of office retirement plans on the market, similar to 401k plans, 403b plans, and 457 plans. Even so, 17% of staff have entry to employer-sponsored advantages however don’t contribute. MagnifyMoney discovered that 12% of staff who don’t return firm matching funds go away the funds on the desk, totaling 17.5 million individuals.

Contemplating opting into an auto-escalation function at your employer can improve your retirement financial savings. On account of this function, your financial savings fee will mechanically be boosted every year by 1% or 2%.

For anybody beneath the age of fifty in 2023, the contribution restrict can be $22,500. A contribution restrict of $30,000 applies to individuals 50 and older. Having an employer who matches your contributions AND maxing out your 401k plan earlier than the top of the yr may also current an issue. After maxing out your 401k plan, you need to cease contributing. In case you cease contributing, your employer is not going to match your contributions.

17. Having an unpayable bank card invoice.

Whenever you use your bank card as free cash as a substitute of utilizing what you may have, you might be on the quick monitor to monetary smash. On this regard, deal with your bank card simply as you’ll a debit card.

Have you ever been fascinated by getting that new iPhone? Fairly than placing it straight in your bank card, solely use it in the event you’re assured you’ll have the ability to pay for it instantly. In spite of everything, even at a considerably affordable 16.99% APR, a $1,000 steadiness would end in month-to-month curiosity prices of $14.06.

Likewise, shopping for now, and paying later companies like Klarna is a additionally large no-no. In accordance with a Shopper Reviews survey, 11 p.c of people that use purchase now, pay later companies miss not less than one cost, actually because they lose monitor of when it’s due or don’t know when it’s due. Others stated they thought they’d arrange computerized funds solely to find they weren’t. They later found that their funds had nonetheless gone by means of, though they thought that they had canceled their buy.

Along with late charges and curiosity prices, individuals who miss purchase now, pay later funds might have their credit score historical past affected.

Moreover, 5 p.c of people that used a purchase now, pay later service stated they couldn’t in any other case afford the acquisition. That may trigger bother: Folks say they miss funds largely as a result of they thought that they had the cash however didn’t.

TL;DR: Be sure you solely buy what you’ll be able to afford.

Being able to repay your bank card or different credit score each month is crucial. Having missed funds in your credit score report can adversely have an effect on your capability to acquire loans or mortgages sooner or later.

18. You aren’t monitoring your credit score scores and studies.

Have you ever ever thought of how your credit score rating can have an effect on your life? A credit score rating is essential while you need to borrow cash, purchase a home, and even hire an condominium. In case you uncover any issues or errors together with your credit score profile, you’ll be able to work together with your lenders to appropriate them.

Due to their significance, it’s very important that you simply often test your credit score rating.

Moreover, Equifax® credit score studies are free every year in the event you create a myEquifax account. To get your free Equifax credit score report and VantageScore® 3.0 credit score rating primarily based on Equifax information, click on “Get my free credit score rating” in your myEquifax dashboard. Credit score scores are available many kinds, together with VantageScores.

19. Dwelling paycheck to paycheck.

The non-public saving fee in the US decreased from 7.5 p.c in December 2021 to three.4 p.c in December 2022. On account of this, it shouldn’t be stunning to study that many households reside paycheck to paycheck. As a consequence, you can not put together for an unexpected downside, which has the potential to turn out to be a catastrophe.

On account of overspending, individuals are put in a precarious place, one the place they will’t afford to overlook a paycheck. Within the occasion of an financial recession, you do not need to seek out your self on this place. Fortunately, there can be only a few choices out there to you if this occurs.

The recommendation of many monetary planners is to maintain three months’ value of bills in a quick-access account. Altering financial situations or lack of employment may drain your financial savings and place you in a debt cycle. In case you don’t have a three-month buffer, chances are you’ll lose your house.

20. Fad investments.

Even when cryptos or fad investments do make you some huge cash in a brief time frame, the disruption to your investing technique may cause you to lose cash long-term. To place it one other means, you need to follow investments which have a confirmed monitor file or solely make investments cash you’re keen to lose.

Or, within the phrases of Paul Samuelson, “Investing ought to be extra like watching paint dry or watching grass develop. If you’d like pleasure, take $800 and go to Las Vegas.”

21. Failing to file taxes or not paying them on time.

If you don’t pay your tax debt, you can be charged penalties and curiosity each month. A lingering steadiness goes to value you more cash in the long term.

The excellent news? A tax debt discount or installment settlement are two strategies the IRS affords for settling delinquent balances. An skilled tax skilled can information you thru the method, sometimes without charge.

22. Loyalty to costly vitality and financial institution suppliers.

It’s time to put an finish to staying loyal to banks and vitality suppliers. You would possibly suppose you’re getting an incredible deal in the event you’ve been a buyer for a very long time. Most often, it will likely be the precise reverse.

Folks are inclined to suppose that switching utilities are a trouble, so banks and different utility suppliers know this. Because of this, they depend on your laziness to maintain your small business and your cash.

Nevertheless, switching financial institution accounts is usually automated immediately. For brand spanking new prospects, some banks provide nice money rewards and rates of interest on financial savings accounts. Whenever you suppose you possibly can discover a higher deal, it’s undoubtedly value buying round.

23. Your profession isn’t being maximized.

Your profession is your most essential monetary asset. For the reason that common American can anticipate to earn round $1.7 million of their lifetime, it’s no surprise. That comes out to simply beneath $42,000 per yr. Nevertheless, in the event you begin at $40,000 immediately and earn 3% pay will increase over 45 years, you’ll earn over $3.7 million.

Briefly, you’ll be able to lose tens of millions of {dollars} in the event you don’t work arduous to maximise your revenue.

So, if you wish to keep away from this unhealthy cash mistake, you merely have to develop and implement a profession plan to maximise your earnings. Additionally, don’t give up your job with out a backup plan. The stress of working at your present job is nothing in comparison with the stress of worrying about the way you’ll pay for important bills.

24. Neglecting your well being.

In accordance with one research, medical causes might account for two-thirds of bankruptcies in the US. Even when that statistic is skewed, everyone knows how tough it may be for households to pay for medical prices.

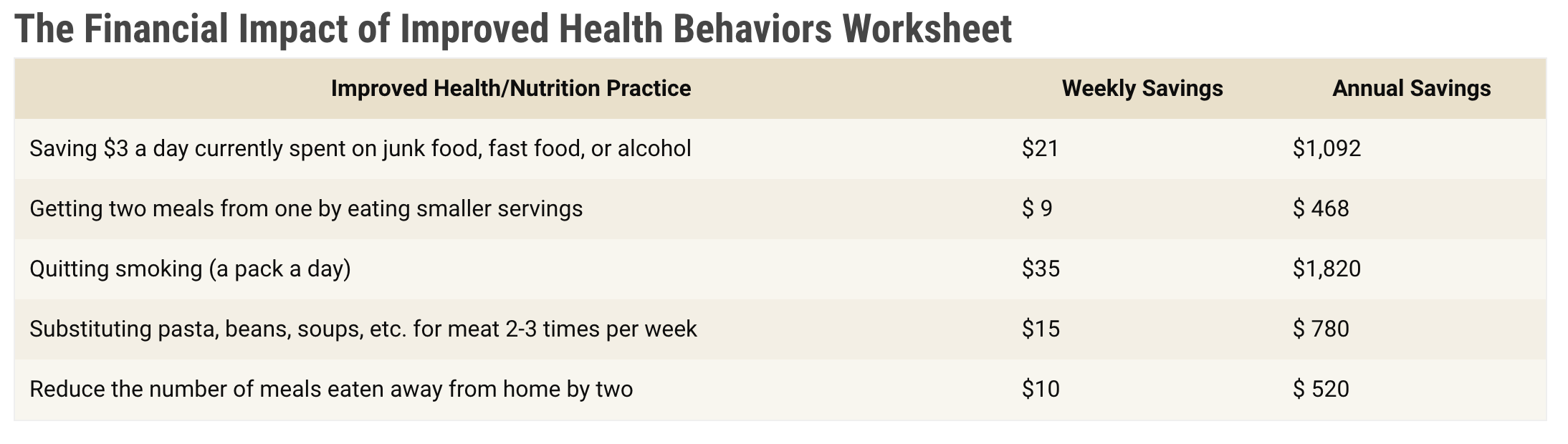

Apart from that, unhealthy habits value some huge cash. For instance, in the event you surrender smoking or junk meals for $10 a day, it can save you $3,650 a yr, plus curiosity. And, these are simply the speedy financial savings.

Lengthy-term financial savings may also be remodeled the course of an individual’s life. Obese individuals may save between $2,200 and $5,300 on their lifetime medical prices in the event that they misplaced 10% of their weight. Elevated medical prices could be lowered by hundreds of {dollars} per yr by delaying the onset of diabetes.

Moreover, employers are more and more recognizing the advantages of wholesome staff. Ultimately, wholesome staff take fewer sick days, so the corporate pays much less out of pocket for medical insurance. As such, corporations might provide monetary bonuses for not smoking or reductions for health club memberships.

25. Reluctance to study funds.

Virtually no private finance schooling is obtainable in public colleges, so many People depend on what they realized from their mother and father. Regardless of pondering you’ve bought issues beneath management, you’ll be able to keep away from many monetary errors by studying monetary literacy and greatest practices.

The excellent news? Studying turn out to be a monetary grasp has by no means been really easy. Educating your self is one of the simplest ways to keep away from making monetary errors, whether or not you watch movies, learn blogs, or take heed to podcasts.

FAQs

What’s a practical finances?

Budgeting and planning your funds could be daunting. Taking the time to look again at your previous spending habits is an actual second of honesty. Do it anyway.

To get began, attempt the 50/20/30 system.

Your cash is split into three classes: 50 p.c for important bills (hire, utilities, automotive cost), 20 p.c for financial savings, and 30 p.c for versatile spending. That’s all there may be to it. In case you’re single and have a tendency to spend most of your meals out fairly than in, the flex proportion works effectively for you.

Is there a restrict to how a lot debt one ought to have?

The reply will depend on the state of affairs. In distinction to bank card debt or what is usually known as “unhealthy debt,” pupil loans are thought of “good debt.” This is because of the truth that pupil mortgage debt has a decrease rate of interest and that getting a level will result in a higher-paying job.

Attempt to preserve your credit score utilization to 30 p.c or much less. Basically, your debt ought to be lower than 20 p.c (together with automotive loans, actual property loans, and private loans).

Are you continue to uncertain? The next questions will provide help to gauge the way you’re doing:

- Is it attainable so that you can make solely the minimal cost?

- Do you skip some payments with a view to pay others?

- Have you ever maxed out your bank cards?

- Are you residing paycheck to paycheck?

You must provide you with a devoted plan if a number of of your bank cards are maxed out. Prioritize paying off the cardboard with the very best rate of interest first, after which decide off the remainder one after the other.

Does it matter if I don’t repay my bank card each month?

The flexibility to lease a automotive, take out a mortgage, or hire an condominium requires a very good credit score rating. All of this stuff are fairly important. Credit score collectors are educated to extend your anxiousness ranges to sky-high ranges when you may have a bad credit score.

Be sure you repay your bank card every month. Get in contact together with your creditor if the debt appears not possible to pay. Maybe you’ll be able to work out a revised cost plan and save a ton of cash on curiosity.

What’s the advisable amount of cash I ought to have in my “Emergency Fund”?

In accordance with monetary circles, three to 6 months’ post-tax revenue is an effective start line. The best is six months, however most of us don’t have any emergency financial savings, so even half that may be a affordable begin.

What’s the proper time to start saving for retirement?

As quickly as attainable. On account of compound curiosity, the sooner you begin saving, the extra you’ll accumulate.

Within the absence of a 401k or comparable mannequin at your employer, think about establishing a private retirement account. You have to take part in your employer’s retirement plan whether it is an choice. As a facet word, if they provide matching, be sure that to make the most of it each time.

It’s also value researching IRA choices, together with Roth IRAs in addition to Conventional IRAs. You may additionally need to study mutual funds, bonds, and extra in the event you’re extra superior in your retirement financial savings.

The publish 25 Methods You’re Killing Your Financial savings: STOP Making These Errors appeared first on Due.