If you happen to journey for enterprise – or use a private automobile for work — likelihood is you are incurring some enterprise bills.

In an effort to be pretty reimbursed, you must maintain monitor of bills in an expense report. On the flip aspect, employers want expense experiences to understand how a lot the enterprise is spending and the place.

Right here, we’ll cowl the fundamentals of an expense report, easy methods to fill it in, and see an instance in motion.

What Is An Expense Report?

An expense report tracks objects and companies that you just buy whereas working. These are sometimes — however not solely — used for enterprise journey.

Though an expense report is important for any worker who desires to be reimbursed for a enterprise expense — like journey, gasoline, or meals — they’re equally essential for the employer. This is why:

1. Correct reimbursements.

This is the rub — workers need reimbursement for the bills they’ve paid out-of-pocket. However, on the flip aspect, employers need assurance that these bills are truthful and legit. An expense report supplies a standardized course of that addresses each these issues.

2. Price management

Expense experiences can help you monitor spending over time and establish whether or not any specific expense class (reminiscent of transportation or accommodations) is driving prices excessively. Then, you’ll be able to strategize easy methods to cut back or remove these prices.

3. Simplifies tax deductions

Many enterprise bills are tax-deductible. Nevertheless, you must precisely report them (with receipts) earlier than claiming a deduction. That is the place expense experiences can come in useful — offering stable proof about when, the place, and the way bills had been incurred.

Now let’s cowl what to incorporate in an expense report and standard enterprise classes.

What to Embrace in an Expense Report

An expense report accommodates a wide range of data — nevertheless, there are a number of particulars you should embrace, such because the:

- Figuring out data of the individual filling out the report — this could possibly be your title, designation, or contact data.

- Date – the date on which you incurred the expense.

- Quantity – the full value of an expense incurred, together with taxes.

- Description – a quick account of every enterprise expense.

- Class – the kind of expense incurred (e.g. parking, workplace provides, or gasoline).

A report may embrace nice-to-have data, like whether or not an expense belongs to a particular shopper or venture, or house to elucidate sure expenditures that don’t match clearly right into a class.

Subsequent, you should calculate (and report) the subtotal for every expense class and the grand complete of all bills.

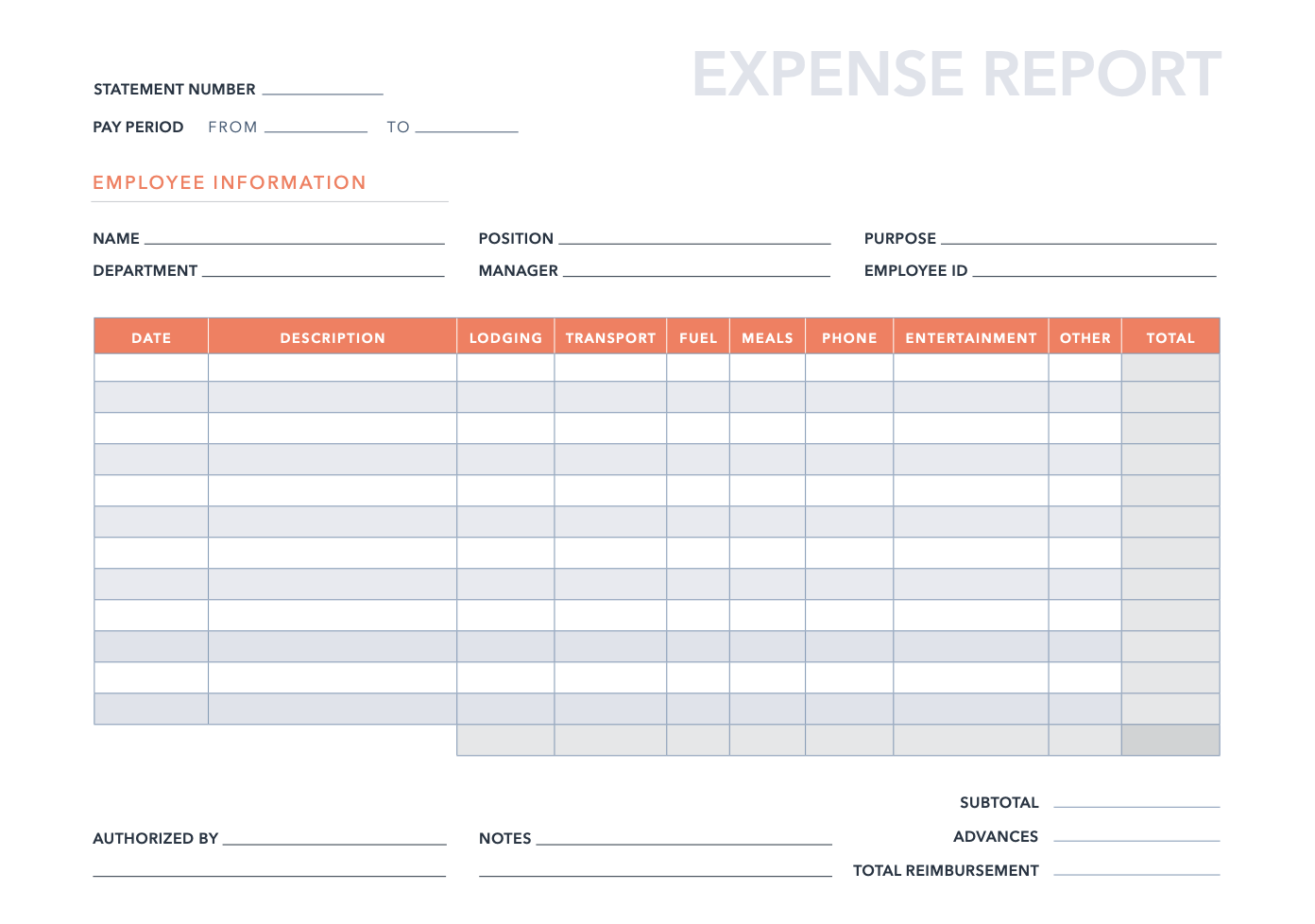

Expense Report Template

Widespread Expense Report Classes

With expense classes, you’ll higher perceive what bills can and can’t be reimbursed. Plus, you’ll additionally alleviate future complications on your bookkeeper or tax preparer.

Talking of taxes, it is a good suggestion to make use of the IRS’ classes in your expense report. This is a listing of the commonest varieties:

- Automotive and truck bills

- Commissions

- Insurance coverage

- Curiosity

- Authorized {and professional} companies

- Membership charges

- Workplace provides

- Postage and delivery

- Repairs and upkeep

- Transportation

- Journey bills (accommodations, meals, parking, and many others.)

- Utilities

- Autos, equipment, and gear

Selecting the best classes will rely in your sort of enterprise. For instance, a drop-shipping firm will dedicate classes for delivery, printing, and storage, whereas an promoting agency might have classes for digital companies.

How you can Fill Out an Expense Report

An expense report can both be stuffed manually or electronically utilizing accounting software program or apps.

Let’s first focus on easy methods to fill out an expense report manually:

- Begin by filling out the obligatory data within the report — reminiscent of your title and designation.

- In chronological order, record every expense beneath the suitable class.

- Together with every expense, embrace the date it was incurred, the full quantity, and a quick description of it.

- Calculate the subtotal for every class and the grand complete of all bills.

- Lastly, connect corresponding receipts to the report. The receipts ought to clearly present the date and complete quantity.

- Submit the report back to your line or division supervisor who will examine it for illegitimate claims or coverage violations.

Many small companies can profit from utilizing an ordinary expense report template. Nevertheless, relying in your dimension or business, it might make sense to make use of accounting software program — like Xero, QuickBooks, or FreshBooks — to maintain monitor of bills.

Additional, bookkeeping apps like Dawn, ZoHo Books, GoDaddy Bookkeeping make it simple for workers to seize receipts, automotive mileage, and different bills on the go.

Remaining Ideas

Expense experiences take the guesswork out of how a lot cash your enterprise is spending and the place it is going. Carried out appropriately, you’ll be able to precisely reimburse workers, simplify your taxes, and even make monetary projections for the approaching yr.

.jpg#keepProtocol)