At this very second, 2.1 billion individuals all over the world are making a fee or sending cash digitally.

Purchasing merchandise, whether or not by way of bodily retailers or ecommerce, works more and more by way of invisible transfers. They’ve enormous benefits each for patrons and sellers: they’re a extra agile, safe and sustainable system for the worldwide financial system – versus the upper prices concerned in managing money and checks.

Why is it essential to supply a wide range of fee strategies?

You could assume that, as increasingly more fee strategies develop into out there in the marketplace, it’s going to be very troublesome to anticipate the wants of your entire clients. However that’s motive to incorporate a wide range of fee methods in your ecommerce enterprise, identical to you’d discover in bodily shops.

If these days it appears antiquated when a retailer doesn’t settle for fee by financial institution card, it can quickly seem outdated for an internet retailer to not provide Apple Pay or PayPal at checkout.

50% of customers will abandon their buy in the event that they don’t see their most well-liked fee system out there.

The benefits provided by different on-line fee methods are:

- Location: Regional fee methods might be integrated together with world strategies.

- Comfort: That is particularly essential for the client, who appears for velocity in on-line purchasing and desires to make safe funds with out revealing an excessive amount of confidential data.

- Viewers: Cost strategies might be tailored to the methods which are most utilized by clients in any given area, or to a selected demographic.

What’s extra, if one among your fee methods causes issues, having additional choices out there is an efficient approach to maintain conversions and keep away from a drop in purchaser numbers as a consequence of technical faults.

That are the preferred on-line fee methods?

It’s no nice shock that probably the most extensively used fee technique worldwide continues to be the bank card.

One motive why different fee strategies will not be extra profitable, is that their adoption price is normally very gradual. Voice assistants and social promoting could also be turning into commonplace, simply because it’s already ordinary to see consumers paying with their smartwatches.

So as of quantity of use, these are the preferred fee strategies worldwide:

- Digital wallets (Paypal, Alipay)

- Credit score and debit playing cards (Visa, MasterCard)

- Financial institution transfers

- Direct debit

- Bill

- Digital playing cards and foreign money

- Coupons and retailer reward playing cards

Really, we have to take the detailed distribution of that worldwide knowledge into consideration. WeChat Pay and Alipay e-wallets are probably the most used, however that’s as a result of two thirds of the worldwide quantity of on-line funds is carried out within the Asia-Pacific area and 50% corresponds to China. If we consider the remaining areas of the world, debit and bank cards are nonetheless the dominant system.

Varieties of on-line fee strategies for ecommerce

Debit and bank cards

As already talked about, these are the preferred technique in the USA, Europe, LATAM and India.

In bodily shops, playing cards are more and more used with an NFC (Close to Discipline Communication) fee system, which permits contactless funds by way of a tool or card. It’s also the popular system for younger individuals: in response to a examine by Deloitte, 80% of transactions made by millennials are made by card.

Tokenization, a system that hides the cardboard quantity from the customer, is spreading to extend safety.

E-wallet

E-wallets are a digital software that lets you embrace playing cards or financial institution accounts (and even crypto-currency) to make funds utilizing one other system, reminiscent of your smartphone or smartwatch. There are world e-wallet strategies, reminiscent of Apple Pay, Microsoft Pockets, Samsung Pay and Alipay, in addition to regional ones:

- India: MobiKwik, Oxigen, FreeCharge, PayU Cash.

- Europe: Payconiq, Payback, Paylib, Lyf Pay, Pingit, Vipps, Swish, MobilePay, OK.

- China: Alipay, WeChat Pay

On-line Banking ePayments (OBeP)

An internet fee system, much less intensive than the earlier ones, which facilitates banking transactions with entry and knowledge in actual time, with out the necessity for a card.

Direct debit

This technique is used to schedule recurring funds, since a request is shipped to the financial institution to authorize funds mechanically, reminiscent of RatePAY, SlimPay, GoCardless or SEPA Categorical.

App funds

These are the Purchase Now buttons which are turning into common on social media platforms, reminiscent of Instagram or Fb, and which make it simpler to pay with out having to depart the app.

Biometric funds

Paying utilizing fingerprint or facial recognition is not only a science fiction trick. Nonetheless, its use continues to be fairly a great distance from turning into widespread, as 61% of customers don’t belief its safety.

Instalment funds

The acquainted fee by instalment is present process a revival due to advances in machine studying, which permit for the evaluation of an applicant’s monetary threat and subsequently deciding which mortgage or instalment fee is greatest suited to her or him. This technique continues to be extensively used for purchases of services or products that contain a big funding.

Rewards

Loyalty playing cards may also function a complement to fee methods, as they promote the usage of a model. An instance is the Each day Money system, launched by Apple in the summertime of 2019, which applies to consumers utilizing their system.

Paying out of your automobile

Connecting vehicles to a fee system is a 230 billion US greenback alternative. As vehicles get smarter and automated driving choices develop, there’s a rising benefit in paying for gas, vitality, parking, tolls or purchasing with out leaving the car.

The 8 greatest fee methods for on-line retailers

PayPal

PayPal is probably the most extensively used on-line fee technique worldwide, and web sites that embrace it at checkout have an 82% increased conversion price. Its platform gives many services for incorporating it into any on-line retailer. On many platforms like Magento yow will discover free PayPal connectors.

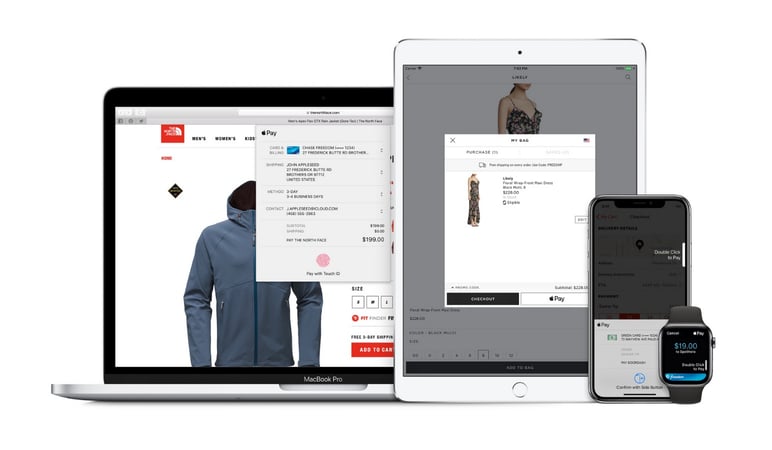

Apple Pay

Apple Pay is the second hottest digital fee system, and increasingly more banks are permitting their customers to hyperlink their playing cards. Within the US promote it has develop into the primary technique, with 54% of the web fee market.

Stripe

Stripe is a extremely popular technique for organising checkout processes in on-line shops. You solely have to include it into the ecommerce platform you’re already utilizing. It’s versatile, customizable and appropriate with most financial institution playing cards and e-wallets in the marketplace.

Sq. is one other extensively used system. Though it’s normally related extra with bodily shops, it additionally contains integration for ecommerce.

Google Pay

The Web big could not resist including itself to the listing, and Google launched Google Pay as its personal fee choice in on-line shops, cellular apps and bodily shops. Its integration in any ecommerce could be very simple by way of API, and it’s a well-liked system amongst customers of Android gadgets.

Masterpass

Masterpass is MasterCard’s digital fee system, though it’s solely helpful for customers of the sort of card. It’s fairly advantageous, because it doesn’t take any commissions and will increase the safety of the fee course of.

Visa Checkout

Just like the earlier technique, Visa Checkout is a fee system developed by Visa for ecommerce corporations who need to velocity up the method for Visa card customers.

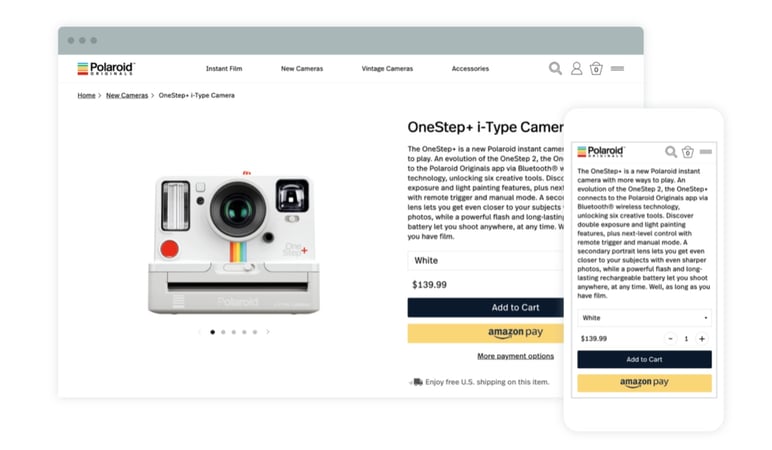

Amazon Pay

The Amazon Pay button doesn’t solely apply to market product pages. It’s a fee choice that Amazon provides to on-line retailers and ecommerce web sites that permits patrons to pay from their Amazon account (the place financial institution card particulars might be saved). Amazon market claims this is without doubt one of the strategies most trusted by customers, and as well as ensures its integration with Alexa voice assistants.

American Categorical

American Categorical is sort of unfamiliar to the European buyer however extremely popular on different continents, with a excessive satisfaction price. It gives service in additional than 170 international locations, though its charges are moderately costly for ecommerce companies.

Essentially the most aggressive characteristic of an internet retailer is to supply the customer with the comfort of selecting between quite a few fee methods and with the ability to pay from any channel. The truth that these methods are safe and have certificates of belief is one other important issue.

Funding in on-line fee strategies might be demoralizing at first, due to the commissions they carry, and the integrations that it’s essential to implement. However the outcomes will present constructive within the quick time period, with extra conversions and higher buyer variety.

Put money into these fee strategies which are most utilized by your clients, and give attention to what issues: providing good high quality merchandise that everybody will need to spend cash on.