That is Half 3 within the collection on API Monetisation. Remember to additionally learn Half 1 and Half 2.

When you aren’t planning on instantly making income out of your API then chances are you’ll want to attract on oblique monetisation fashions to construct your enterprise case. Typically talking, oblique API monetisation is the place you hyperlink the influence of your API by means of to income drivers elsewhere within the enterprise.

This can be a frequent type of monetisation that’s largely related for companies with current income streams, equivalent to current enterprises and software-as-a-service firms.

Measuring the income generated by direct API monetisation is straightforward. Measuring oblique monetisation is a bit more sophisticated, and also you’ll have to work out which metrics and leavers are going to influence direct measures of income.

That will help you construct your API enterprise case round oblique monetisation, this part of the API Monetisation Information covers:

- Income Linked Monetisation

- Inner Billing

To be taught extra concerning the cost-saving advantages of APIs, see Half 1 of this complete API Monetisation Information.

You could possibly hyperlink your API’s influence to income earned elsewhere within the enterprise.

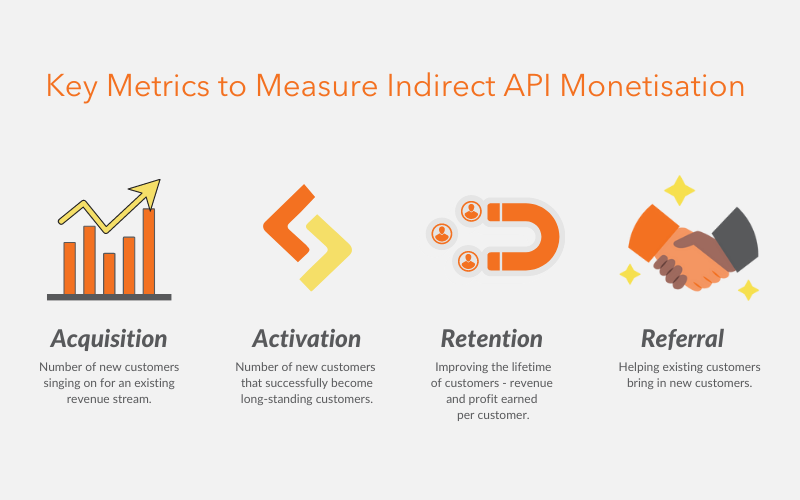

The important thing metrics you need to use to do that are:

- Acquisition: Can your API enhance the variety of new clients signing on for an current income stream?

- Activation: Can your API enhance the variety of new clients that efficiently turn out to be long-standing clients for an current income stream?

- Retention: Can your API enhance the lifetime of your clients, the income earned per buyer, or the revenue per buyer?

- Referral: Can your API assist clients refer new clients?

You may be acquainted with this because the Pirate Metrics (A.A.R.R.R.) that drive the pondering behind most tech firms at this time. The third R from the Pirate Metrics, Income, was coated within the Direct Monetisation part of this information.

Every of the metrics is explored in additional element under.

You should utilize an API to drive signups from new clients or new customers. You’ll be able to then measure the worth of your API within the income gained from these new signups.

E-commerce and insurance coverage present examples of APIs that drive acquisition. For instance, Amazon supplies an API for third events to construct their very own purposes utilizing Amazon merchandise, fulfilment info, feeds, opinions and extra. In insurance coverage, CoverGenius supplies an API for the likes of Skyscanner and Ryanair to enroll clients onto their insurance coverage merchandise.

Typically talking, your components for figuring out the brand new buyer income pushed by your API will take two varieties: (1) Taking a look at general income, and (2) Attributing a portion of the income to the API.

The general income is comparatively simple. You estimate or observe the purchasers that come from the API and the income that they convey (or will convey).

The attribution method recognises that the API isn’t solely accountable for the entire income and that different elements could also be contributing. For instance, an API couldn’t drive the acquisition of a product that doesn’t exist. It’s good to calculate and steadiness an acceptable portion of the income to attribute to your APIs.

You should utilize an API to drive the variety of new clients that efficiently begin or proceed to make use of your product-this known as activation. You’ll be able to then measure the worth of your API within the income gained from clients that normally would have churned.

Activation is much less frequent for APIs to give attention to, and solely tends to seem with software-as-a-service or technology-enabled service choices. For instance, an accounting software program service like Xero makes use of an API to assist folks join different methods, like financial institution accounts, which makes folks extra more likely to succeed with Xero.

Similar to acquisition, activation will be measured by attributing a portion of the general income gained from having the API.

That being mentioned, lots of the API’s activation options may additionally fall within the retention class. Activation is a much less frequent oblique monetisation method for APIs.

You should utilize an API to assist guarantee clients keep together with your product and enhance the quantity they pay for its use. You’ll be able to then measure the worth of your API by the income gained from the purchasers that keep or enhance their spend.

It appears easy, however it may be fairly sophisticated. There are easy conditions the place clients keep due to the API, however as a rule it’s a bit much less clear. The API might have been simply certainly one of the concerns that led them to staying or growing their spend.

In SaaS, Atlassian’s in depth use of APIs to permit their clients to combine with and construct upon their merchandise is a key purpose for his or her success. As soon as a buyer has comprehensively built-in Atlassian’s merchandise with their methods, it’s a troublesome resolution to shift elsewhere.

Elsewhere, conventional banks are beginning to lose clients and companions to the likes of Stripe, Paypal, and neobanks as a result of banking APIs aren’t obtainable or are too difficult to make use of.

To measure the income influence your API has on retention, you possibly can measure the income gained from clients, in addition to by attributing a portion of the general income to the API.

There’s a chance to get clever together with your attribution. For instance, you possibly can run surveys to find out the portion of consumers for whom the API is a key issue. You may make estimates of the significance of the API primarily based on the utilization of options. You’ll be able to then use these numbers to tell what proportion of income gained from a particular buyer to attribute to the API.

You should utilize an API to assist with referral, though it’s much less frequent, so we gained’t go into it with as a lot element as the opposite metric areas.

Fb’s APIs for sharing and different social interactions are instance of this.

To measure the income influence of your API on referral, you’d measure the variety of clients or customers your API brings and mix this with the income they generate or are anticipated to generate for you.

One other solution to not directly monetise your API is to invoice for it internally. That is most suited to bigger firms with a longtime mannequin of inner cross charging.

On the floor it’s a easy mannequin: simply cost some quantity for different departments to make use of the API. However, because it’s not at all times instantly clear how a lot you possibly can cost for the API, discovering an acceptable value will be sophisticated.

Listed here are some fashions that may match:

- Value plus — You’re taking the price of offering the API, then add a proportion for loading, margin, or contingency (20–30% is a quantity that arises typically right here). You have to to keep in mind setup prices, base working prices, and per transaction/utilization prices.

- Utilizing comparables — If the API you’re offering has externally comparable APIs then you possibly can replicate their charging mannequin of these APIs. For instance, in the event you had been to offer a Stripe like funds API to different enterprise items, then you might use Stripe’s pricing to find out the way you value your API internally.

- Income share — You negotiate a share of the income different enterprise items acquire by having your API. This does overlap with a few of the different fashions mentioned elsewhere on this information although.

You might also look to mix features from every of those inner billing fashions.

On this part of the API Monetisation Information, we coated Oblique API Monetisation. We checked out linking your API to income by means of metrics like acquisition, activation and referral. We additionally checked out inner billing fashions

Initially printed at https://terem.tech on March 9, 2022.