Likelihood is you’ve heard quite a bit about your private credit score rating. Do you know that companies even have credit score scores to watch?

One of the simplest ways to do that is by utilizing a small enterprise credit score monitoring service!

This text talks about small enterprise credit score monitoring providers and why you want one. We additionally go into just a few of our favorites and components to think about when selecting the best service for you.

What’s a Small Enterprise Credit score Rating?

Small enterprise credit score scores are like private credit score scores for companies. They assist folks determine whether or not to provide cash to an organization.

Simply as private credit score scores have a “huge three” in the case of credit score reporting businesses (TransUnion, Equifax, and Experian, all of which inform FICO), enterprise credit score scores have a “huge three.” These are Dun & Bradstreet (D&B), Equifax, and Experian. To get a full thought of what you are promoting credit score rating, you must monitor all three.

Different enterprise credit score rating providers exist, however they’re used far much less typically. In case you’re contemplating getting a mortgage, discuss to your lender about what they use earlier than making use of.

A couple of variations between private and enterprise credit score scores are:

| Enterprise Credit score Rating | Private Credit score Rating | |

| Rating Vary | Normally 0-100 | 350-850 |

| Typical “Good” Rating | 75+ | 670+ |

| Components | Credit score age, cost historical past, debt and causes for debt, firm dimension and age, business threat | Credit score age, cost historical past, debt, credit score combine, current credit score rating pulls |

| Who Can Examine | Public data | Solely customers with permission |

| Identifier | Employer Identification Quantity (EIN) | Social Safety quantity (SSN) |

| Widespread Credit score Reporting Corporations | D&B, Equifax, Experian | FICO, knowledgeable by Equifax, Experian, TransUnion |

Notice: This data applies to US-based companies working throughout the States. Enterprise credit score rating wants and availability might differ by nation. One useful resource for firms that want to watch worldwide companions is Experian’s Worldwide Enterprise Reviews and Assets. Make sure to analysis what you are promoting’ credit score monitoring wants when you go international.

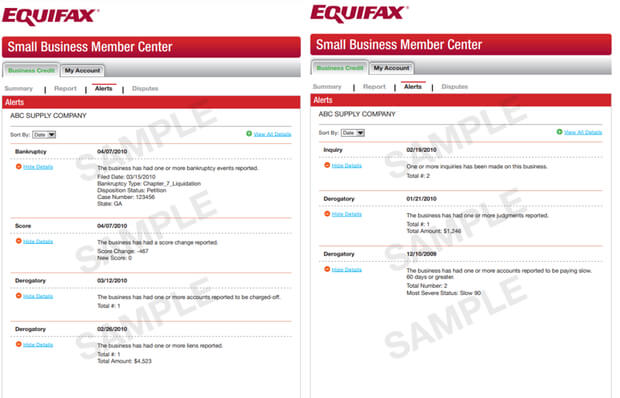

All small enterprise credit score monitoring firms’ reviews look completely different. Nonetheless, right here is an instance from Equifax to provide you an thought of what to anticipate:

What’s Small Enterprise Credit score Monitoring? Do I Want It?

A small enterprise credit score monitoring service lets you understand when what you are promoting credit score report adjustments.

You want a small enterprise credit score monitoring service to look at your rating and cease issues. In case you don’t use a enterprise credit score monitoring service, you gained’t obtain alerts when issues go sideways.

The perfect credit score monitoring providers for small companies provide you with a warning to many points. However, virtually all can cease two main issues:

1. Incorrect Small Enterprise Credit score Rating Data

Credit score businesses use data from third events to create what you are promoting credit score rating. This data could also be outdated or mistaken. Small enterprise credit score monitoring providers may help you repair hiccups like these.

2. Small Enterprise Fraud and Id Theft

The information reviews on hackers stealing folks’s identities or utilizing their cash. However do you know firms may also face fraud and enterprise identification theft?

After one other firm’s emails have been hacked, Syed Balkhi, OptinMonster’s co-founder, misplaced practically $1.4 million. It took weeks and the assistance of the Division of Homeland Safety to repair the problem.

He says, “most individuals aren’t this fortunate,” as he acquired most of his a reimbursement. Guaranteeing you and any firms you’re employed with have good, safe credit score may help preserve you protected.

Small enterprise credit score monitoring providers search for fraud and assist repair the issue. Many providers supply this as a part of their packages, however some have fraud safety as an add-on.

High 7 Small Enterprise Credit score Monitoring Providers

There are dozens of small enterprise credit score monitoring providers. These 7 are our favorites due to their buyer opinions, value, customer support, or a mix of these. They’re in no specific order.

1. Id Guard

Id Guard affords particular person and enterprise identification theft safety. They provide two enterprise credit score monitoring providers:

- Breach Response Worth: $1 million in identification theft insurance coverage, breach alerts, darkish internet monitoring, and extra; $36 per code per yr

- Breach Response Whole: Identical as above, plus monitoring of financial institution accounts and main enterprise credit score bureaus; $120 per code per yr

Id Guard’s worker advantages program makes them stand out. They partnered with Aura to offer identification theft safety to staff. This partnership may very well be worthwhile, as employee identification theft can value firms as much as roughly $1.6 million.

Talking of Aura, along with their enterprise partnership program, the corporate affords particular person and household fraud and identification theft safety. In case your employer can’t present identification theft safety as a profit, it’s value wanting into your self.

With Aura, you possibly can select between three completely different plans:

- Primary: On-line account, private data, SSN, and identification monitoring, $1 million insurance coverage, misplaced pockets remediation, and machine and community safety; $10 particular person or $17 household per 30 days, billed yearly

- Whole: Primary plus monetary fraud safety (together with credit score monitoring); $20 particular person or $29 household per 30 days, billed yearly

- Final: Whole plus dwelling title, handle, legal, court docket, 401k, and funding monitoring, one annual credit score report, and white-glove decision; $30 particular person or $39 household per 30 days, billed yearly

Roughly one-third of Individuals have their identities stolen sooner or later, and it could actually take weeks, months, or years to resolve–if it ever resolves in any respect.

3. Nav

Nav affords private and small enterprise credit score rating monitoring with 24/7 alerts.

They watch the D&B PAYDEX, Intelliscore Plus from Experian, FICO® LiquidCredit® Small Enterprise Scoring Service, and Equifax Delinquency Danger Rating.

They’ll additionally assist you determine financing choices it’s possible you’ll qualify for.

In different phrases, they’re very thorough.

You may get a free enterprise credit score report, however it is advisable pay if you need monitoring and never only a report.

4. Credit score Suite

Credit score Suite takes small enterprise credit score monitoring a step additional. Not solely do they observe your credit score as different firms do, however additionally they assist you and what you are promoting credit score in different methods.

Do you want assist establishing credit score, discovering cash, or understanding funds? Credit score Suite’s program has all this and extra.

Their core program runs $2,997 for a single cost or $597 per 30 days over seven months.

5. Dun & Bradstreet CreditMonitor™

D&B’s enterprise credit score monitoring service could also be a smart alternative, as this is among the “huge three” enterprise credit score rating firms. It solely displays D&B scores.

You could choose from three D&B enterprise credit score monitoring providers:

- Credit score Sign ®: 4 scores and rankings for 2 weeks; reveals enterprise credit score inquiries and adjustments to scores and rankings; free

- CreditSignal® Plus: Exhibits 5 scores and rankings as many occasions as you need; contains credit score inquiries, adjustments, and occasions; $15/month

- CreditMonitor™: Limitless rankings and scores; has the above plus darkish internet monitoring and business comparisons; $39/month

6. Experian Enterprise Credit score AdvantageSM

Experian is one other “huge three” small enterprise credit score reporting group. Like D&B, it solely tracks its personal credit score scores.

You may select from 4 choices:

- CreditScore Report: A primary abstract, rating, and threat ranking; expenses per report

- ProfilePlus Report: Detailed credit score report and historical past; expenses per report

- Valuation Report: Determines what you are promoting worth and efficiency indicators; expenses per report

- Enterprise Credit score Benefit: All of the above plus helps you to dispute points; has an annual payment

You could select to run a report on different companies as an add-on.

7. Equifax Enterprise Credit score Monitor for Small Enterprise

Equifax Enterprise Credit score Monitor for Small Enterprise tracks clients’, companions’, and distributors’ Equifax scores. That is the final of the “huge three” firms.

By “clients,” we imply different companies you’re employed with. You’d use this to verify this buyer is a protected wager in your firm. For instance, you may see if they’ve a strong historical past of paying their money owed earlier than working with them, or be careful for crimson flags as your partnership continues.

This service supplies detailed messages about credit score exercise and as many credit score reviews as you need.

You may additionally add chapter, derogatory marks (e.g., late funds), new inquiry, and Equifax rating drop alerts.

Which Enterprise Credit score Monitoring Service Is Greatest for My Small Firm?

There isn’t a single finest small enterprise credit score monitoring service for each firm. However, you possibly can ask your self some questions whereas deciding:

- Why do I wish to watch my small enterprise credit score?

- What number of bureaus do I wish to watch?

- Do I would like perks past monitoring, like on-line workshops?

- How a lot can I afford to spend?

Small Enterprise Credit score Monitoring FAQs

How do I examine my small enterprise credit score rating?

You should purchase reviews from Experian, D&B, and Equifax when you don’t use small enterprise credit score monitoring.

Why is my small enterprise credit score rating necessary?

A wonderful small enterprise credit score rating may help you get enterprise loans, bank cards, and different funding. A poor or nonexistent credit score rating might imply utilizing your private cash on what you are promoting.

Why ought to I take advantage of small enterprise credit score monitoring after I can examine scores?

Monitoring your small enterprise credit score rating lets you understand what potential lenders see. It additionally helps you to deal with issues as they come up reasonably than making an attempt to do injury management.

Small Enterprise Credit score Monitoring: A twenty first Century Should-Have

You want the most effective small enterprise credit score monitoring service to remain protected.

Understanding about fraud instantly is important. However, issues aren’t at all times so dramatic. A mistake on a small enterprise credit score rating report may also trigger complications.

Above, we advised six of the most effective small enterprise credit score monitoring providers. Nonetheless, it’s necessary to analysis choices to see what suits your organization’s wants.

In case you’re visiting our website, you in all probability wish to learn to enhance what you are promoting. That’s what OptinMonster is all about–we wish to show you how to convert your website’s guests into clients! Keep awhile, discover our website, and see how we may help you obtain your objectives.