Globally, 88% of shoppers say “seasonal reductions set off me to make extra on-line purchases”, however is worth discounting the very best technique in 2022? Outcomes from the 2021 Black Friday season counsel “premiumization” or upselling is tapping into shoppers’ need for worth for cash (versus ‘low-cost’) and a unbroken give attention to enhancing the ‘at residence’ expertise.

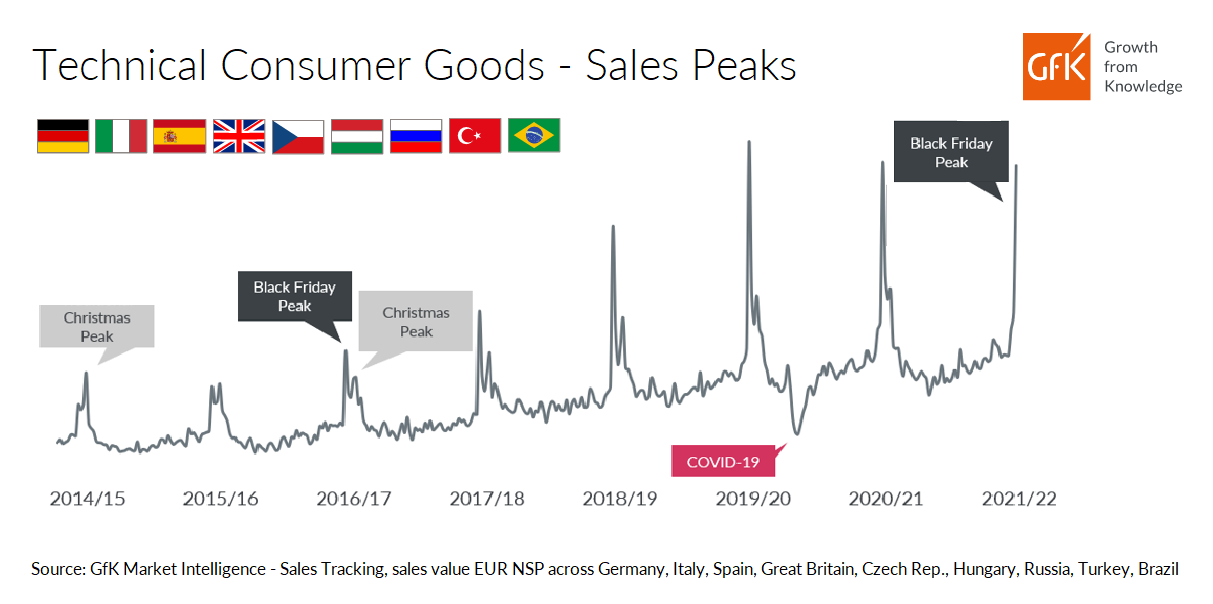

One of the constant drivers bringing a surge of consumers to retailers 12 months after 12 months is seasonal promotion. For the final six years, Black Friday peak gross sales for Client Know-how and Durables (T&D) have recurrently outstripped Christmas peak gross sales. For 2021, Black Friday season (weeks 45 – 47) even managed so as to add +1% worth progress in comparison with 2020, regardless of the problem of 2020 being a strong-performing interval itself. It’s not all excellent news, nonetheless. Final 12 months was the second 12 months in a row of lowering progress for Black Friday week (week 47) in comparison with the typical week – probably giving us an early signal of client saturation with seasonal promotions and the chance to draw their spending extra evenly throughout the 12 months.

Whereas Black Friday season stays an essential promotion peak for retailers outdoors China, counting on seasonal promotions that concentrate on enticing reductions could be a double-edged sword for producers and retailers who additionally have to safe margins and intention to keep away from a ‘conflict of costs’.

One reply is to construct a technique that focuses on upselling with both temperate discounting or gives comparable to prolonged warranties or free set up, and so forth. This mix faucets into a number of the core private values that customers globally say are most essential to them and that affect the best way they reside and the alternatives they make. Specifically, “worth for cash”. It is a completely different mindset to being motivated purely by a low worth band and shoppers rank this third out of 57 private values, making this a key motivator.

The significance of stressing worth for cash in any provide is underlined by the truth that shoppers’ perception that ‘you will need to indulge myself sometimes’ has dropped a number of locations during the last 12 months, now standing at twenty third place. Whereas that is nonetheless within the prime half of the essential values, the drop means that consumers are reacting to the rising value of dwelling and tough financial instances and turning into extra cautious about what they’re keen to spend their cash on.

Customers trending in direction of high quality over amount

As explored intimately in our State of Know-how & Durables Report 2021 (obtain free right here), final 12 months noticed a rise in shoppers choosing high-end producers recognized for high quality and good design. The explanations for this are quite a few, together with components comparable to further disposable earnings as a result of discount in spending on areas comparable to leisure journey and commuting, an appreciation of the significance of Client Tech and Durables in individuals’s new home-centric life, but in addition an appreciation of getting high quality for one’s cash.

These components have meant that premium manufacturers – these with a worth index of above 150, calculated by nation and product group – accounted for almost 1 / 4 of final 12 months’s T&D gross sales globally. This development for premium items was unfold fairly evenly throughout the 12 months, somewhat than being confined to seasonal occasions (the 7 months Jan–Jul 2021 noticed 43% 12 months on 12 months worth progress) and was significantly excessive in APAC and LATAM with 53% worth progress for premium items in each areas, in comparison with simply 16% (APAC) and 30% (LATAM) for extra budget-friendly items.

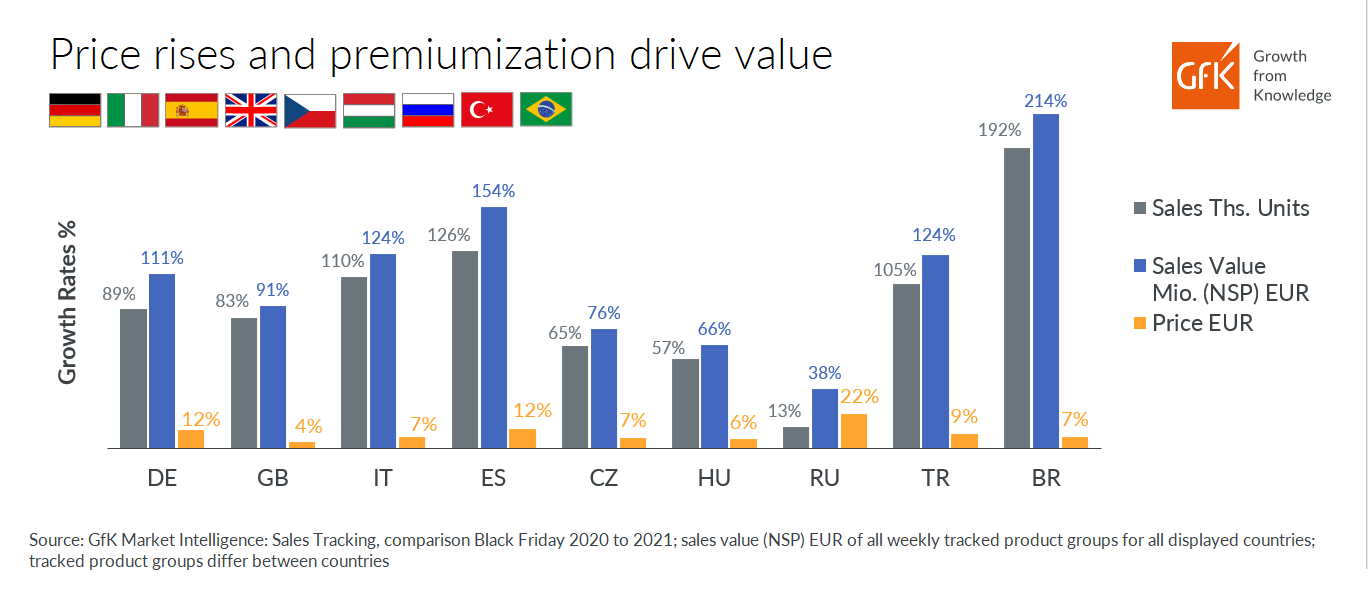

Evaluation of the 2021 Black Friday efficiency bears out this rising client attraction for premium merchandise, with the expansion in gross sales worth for client T&D items throughout a lot of key international locations being pushed up by larger costs of products purchased, greater than the variety of objects offered.

This turned out to be a lifeline for producers and retailers, given the lowering progress for Black Friday week gross sales in comparison with a median week – seen in each 2020 and 2021 throughout a lot of international locations. The long-term image is that consumers are turning to high quality over amount – and types in a position to tailor their 2022 technique to cater to this mindset may gain advantage from the elevated margins that higher-end items provide.

“This shift from discounting to premiumization could be a game-changer for Tech and Durables corporations who uncover what motivates shoppers in particular markets”, says Louisa Hyperlink, GfK’s business account director in North America. “The retail surroundings on this class is ripe for innovation. Customers are exhibiting us they need worth for his or her cash – particularly in key important classes.”

Outlook on premiumization in 2022

Client strain on companies to maintain costs down won’t ever subside – however that is unlikely to cease the rising prices of operations and uncooked materials being handed on to consumers. As manufacturers look to justify larger costs, this may increasingly nicely drive a supply-side transfer in direction of premiumization that can run alongside the demand-side client preferences. Add this to the truth that premium merchandise usually carry larger margins, and the attraction of a give attention to premiumization as a technique for 2022 is obvious.

After all, a serious risk to the continued client attraction in direction of premium merchandise is the excessive inflation throughout many markets. If the rising worth of each day dwelling begins to stability out the financial savings from decreased commuting prices and restricted abroad journey and so forth, the development in direction of premiumization might endure a success for a big portion of the worldwide inhabitants. Nonetheless, the chance stays for producers and retailers to focus this technique on client teams which have a higher tolerance for inflationary spikes, in comparison with these with much less disposable earnings. It’s subsequently important for manufacturers to understand the detailed make-up and weight of related client teams and plan their technique accordingly.

“Our evaluation throughout markets suggests individuals are able to make a aware effort to save lots of their funds to allow them to afford to spend money on premium manufacturers. The give attention to enhancing the house surroundings for each work and leisure will proceed, though with indicators of saturation in sure product teams. Individuals don’t simply need merchandise to do what they’re alleged to do, they wish to get that sturdy feeling of worth gained. Meaning upgrading to home equipment and merchandise for the house which can be nicely designed, fantastically crafted, and seamless to make use of – and supplied with a bundle that the buyer sees as worth for cash. That doesn’t essentially imply worth alone; enhanced worth can even come by means of gives comparable to prolonged warranties, free supply or set up, or customization choices,” says GfK Chief Advertising and marketing Officer Gonzalo Garcia Villanueva.

The important issue for achievement lies in the truth that, whereas premiumization gives the potential to drive income progress for producers and retailers, rolling out a premiumization technique in France is completely different than rolling one out in Poland. Each market has its personal nuances and variations in what is going to set off consumers inside completely different product teams. To remain profitable, your technique should be constructed on correct, updated and complete market and client intelligence.

Be taught extra in regards to the present state of Client Know-how and Durables market and our 2022 projections