Estimated learn time: 7 minutes, 6 seconds

In keeping with an OpenView survey, by 2023, 56% of SaaS firms will probably be utilizing or anticipating to check usage-based pricing, which they outline as “a pricing mannequin that permits prospects to pay for a product in line with how a lot they use it.”

Utilization-based pricing (UBP) — or consumption pricing — relies on the quantity of utilization of a particular metric, akin to gigabytes of storage used or the variety of API calls made — over a time period.

This manner of pricing SaaS merchandise is tremendous common proper now, however that doesn’t imply it’s the perfect match for many firms.

Right here’s my tackle it in a nutshell:

→ UBP is trending as a answer to an previous downside: pricing must precisely mirror worth — for either side. UBP can higher align worth so consumers and sellers understand the deal to be truthful.

→ BUT that doesn’t imply it’s proper for everybody — and in reality you would possibly already be deploying a model of UBP.

→ Seat-based pricing (SBP) is a usage-based metric. The query so that you can take into account is: is the variety of customers (or seats) probably the most extremely correlated metric with worth?

→ Don’t get sucked into utilizing UBP as an answer searching for an issue. As you concentrate on pricing, give attention to one factor: is pricing perceived to be truthful.

On this piece, I’ll break down my ideas on usage-based pricing and how one can resolve if it’s value investigating in your firm.

Why Is UBP Trending?

SaaS pricing is hard to optimize. One main motive is there are only a few limitations. With excessive gross margins and few technical constraints, merchandise can actually go wild with their pricing and packaging in ways in which we don’t see in different industries.

SaaS can also be a really younger trade, and we’re nonetheless within the early phases of ideation round pricing, packaging, and even gross sales fashions. The most effective firms are innovating quickly, not simply on their product however within the methods they monetize. In some ways, we’re initially of the start, and usage-based pricing provides individuals a extra accessible approach of approaching pricing.

That is all very thrilling, but it surely additionally implies that, with fewer limitations and well-tested finest practices, we are able to simply get caught up within the “subsequent massive factor.”

So why is UBP “the subsequent massive factor”?

Like many traits, usage-based pricing is a catchy title with current success tales that play on an current idea — pricing pretty. Customers, whether or not they’re companies or people, wish to really feel like they’re paying a good value. On the earth of SaaS, prospects are making that call each time they renew or after they enable one other month-to-month cost. However equity cuts each methods. SaaS suppliers must also be compensated pretty for the worth they ship, and typically that worth will increase because the product frequently improves and the purchasers’ utilization will increase. Designing a pricing mannequin that optimizes for equity — in each instructions — is a basic tenant of SaaS pricing. To do this successfully, the metric upon which your pricing relies must be as near the purchasers’ perceived worth as potential.

When completed proper, UBP accelerates you towards this reply. It’s essential to acknowledge, nevertheless, that alignment with worth will not be the one consideration when arising with a perfect pricing metric that’s linked to worth. There are two concerns that you need to optimize:

- Linked pricing metric as carefully to worth as potential (the equity precept)

- Make your pricing as easy and straightforward to forecast as potential

The diploma to which you weigh one versus the opposite will depend on a wide range of components together with your market, what your rivals are doing, common value level, product sort, and the desire of your consumers. It sometimes takes time to seek out the proper steadiness in your product and your market, and there are not any shortcuts. Steady testing is the one confirmed path to success.

More often than not, whenever you learn or hear one thing about UBP, it’s positioned as a substitute for seat-based pricing, which has been the dominant gross sales mannequin for B2B SaaS firms.

(However even with extra firms attempting out different metrics and pricing fashions, seat-based pricing is nonetheless the most typical B2B mannequin.)

However one of many largest causes that UBP is trending is as a result of there have been some main success tales round current IPOs of firms utilizing this mannequin, akin to Snowflake, Twilio, and Agora.

These success tales are intriguing however shouldn’t be blindly copied. As a substitute, take into consideration the underlying components making UBP work for sure companies by asking three inquiries to summary the learnings away so you may finest apply them to your personal state of affairs:

- How is their pricing metric correlated with prospects’ notion of worth?

- How is the complexity (or simplicity) of their mannequin impacting their gross sales and renewal course of? Does it gradual it down or pace it up? Does it make it simpler or more durable?

- How is their pricing mannequin positioned relative to their rivals? Is it distinctive or comparable? What are the professionals and cons?

What Do Many UBP Success Tales Have In Widespread?

It’s straightforward to have a look at firms which have efficiently gone public with big valuations and wish to sample match to seek out issues you may apply to your personal enterprise.

However there are a few issues that the majority of those firms have in widespread that make usage-based pricing notably efficient for them. And earlier than assuming that UBP will probably be proper for your small business, you’ll wish to see if your organization additionally has these traits.

1. The Mannequin Lends Itself To A Measurable Utilization Metric

Profitable UBP firms all have a main pricing metric, for instance:

- Snowflake: Compute and storage utilization

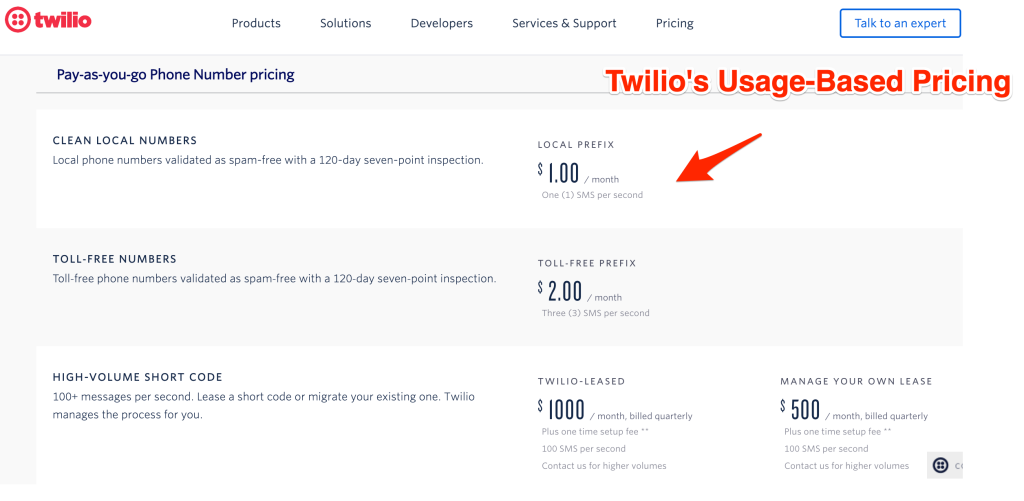

- Twilio: Quantity of cellphone numbers used, name lengths or messages despatched

- Agora: Name or stay stream lengths or messages despatched

These metrics may be simply tracked and estimated by their prospects. That is an usually ignored actuality – in case your prospect can’t simply forecast how a lot they may pay, you make their potential to purchase from you way more troublesome. That is notably true for enterprise software program the place spend must be budgeted.

2. The Success Tales Have a tendency To Have Lengthy-Time period Time Horizons

One other essential commonality of profitable UBP fashions: the targets are far-sighted. Selecting this monitor permits firms to do issues within the early and even progress phases of the corporate that have been oriented round long-term worth maximization.

For instance, extra novel B2B merchandise usually use UBP to cost very low within the first 12 months or two with a buyer, to allow them to show the worth and achieve buy-in. Then over time, as that firm grows, so does the typical income per person (ARPU) and revenue margin.

Whereas usage-based pricing IPO success tales are very compelling, they undersell the preliminary deal years after they in all probability left cash on the desk attributable to a extra conventional pricing mannequin. In the end, that worth is catching up lately, and that’s why we see simply astronomical internet greenback retention numbers.

However companies have very totally different time horizons that they function beneath. Be sure to know what’s best for you and your small business first. If you happen to’re funding different tasks with money move, then it’s possible you’ll not have the chance to shift to a long term time horizon.

Is UBP Value Investigating For Your Firm?

If you happen to’re contemplating UBP, it implies that you’re re-evaluating the worth metrics that you simply’re utilizing to cost your merchandise.

And as an alternative of limiting your self to metrics that usually fall into the UBP camp, I’d urge you to easily take into account what your preferrred worth metric or metrics may be – begin there.

It may be seats, it may be gigabytes, or minutes. Or it may be {that a} extra tiered method with bundled options would work finest.

Assessing the first and subsidiary worth metrics you employ for pricing and packaging is without doubt one of the most essential progress levers you may pull — so in the event you’re questioning your pricing mannequin, you’re heading in the right direction. However pause if you end up contemplating UBP simply due to the success or hype out there.

Reside Interview With Kurt Smith on Pricing Methods to Fight Stagflation

Be a part of us for a stay interview with FastSpring’s Chief Product Officer Kurt Smith about pricing methods to contemplate in risky markets. RSVP and be taught extra.