The potential for hybrid work fashions has been a subject of debate because the web launched. And whereas we had the capability, not even essentially the most revolutionary tech corporations absolutely embraced the concept till the coronavirus pandemic started. Since then, this radical method of working has turn into mainstream — progressing from being an answer to an emergency, to a brand new versatile, refined, and productive actuality. Whereas the approaching years gained’t see firm HQs deserted, neither will we witness a return to conventional workplace life. As ever, the longer term isn’t this or that — it’s this and that.

Every group will attempt to discover its optimum place on the spectrum between a centralized bodily house, and a wholly digital, distributed community. Wherever companies place themselves, it’s clear that industries have been drastically altered by widespread working from house, and the Shopper Tech and Durables sector isn’t any exception. The sector has thrived — technological innovation and overarching cultural developments have been supercharged by the pandemic to create an ideal storm of demand.

The worldwide surge in house workplaces has reshaped the Tech and Durables panorama, driving customers to outfit their homes as each productive work environments, and seamless, upgraded hubs for leisure, training, and well being. 2022 nonetheless carries the potential for additional progress, however there are dangers that decision-makers will want foresight and ingenuity to beat.

How has working from house impacted the Shopper Tech and Durables sector to this point?

As lockdowns had been applied throughout international societies, employees who had been capable of keep their earnings with out bodily attendance acclimatized to a brand new distant actuality. Workplace life was substituted for crouching over laptops at kitchen tables and liaising with colleagues on Zoom. For these employees, the house turned a spot that needed to fulfill a never-before-seen demand for each productiveness and leisure.

This triggered a gross sales growth in Tech and Sturdy merchandise, powered by peoples’ urge to improve their properties into all-encompassing hubs. With working from house rising as a brand new, everlasting lifestyle, customers invested and have continued to put money into preparation for a hybrid future. In keeping with GfK knowledge, international gross sales within the sector reached $646bn between January and September in 2021, an 18.1% improve on the identical interval in 2020. Whereas this may appear unsurprising, these international gross sales figures are 14% greater than the primary seven months of 2019, a interval wholly unaffected by COVID-19.

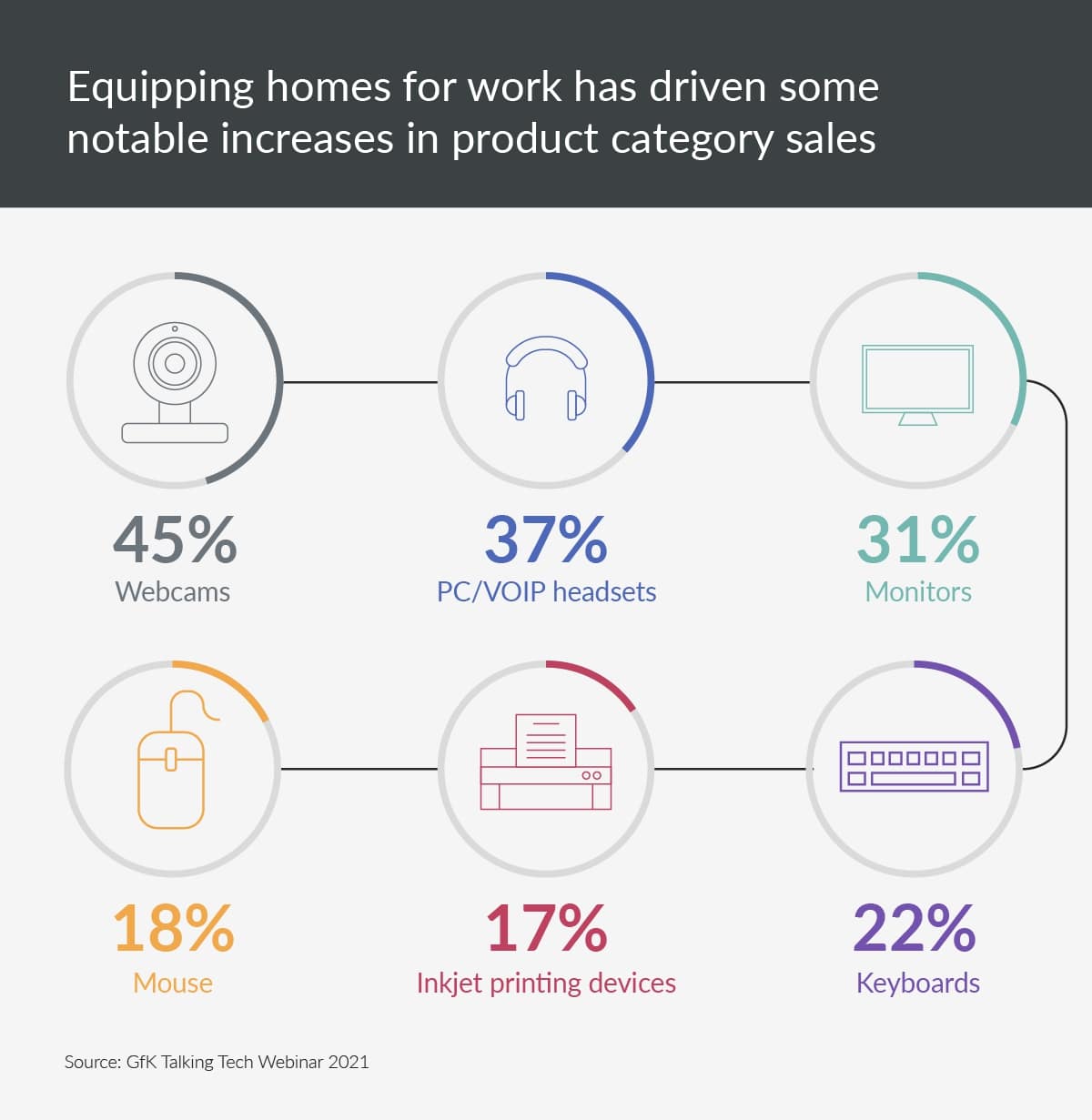

Knowledge reveals that buyers had been keen to spend cash on necessities that made their house workplace extra productive. When in comparison with the primary 9 months of 2020, January to September 2021 noticed gross sales of things that improve the earn a living from home desk soar: webcams elevated 45%, displays 31%, and PC/VOIP headsets 37%. However past the assignments, tasks, and conferences, working from house has amplified the demand for a few of life’s pleasures too. In the identical months, gross sales of sizzling beverage makers elevated by 44%, whereas gaming mice noticed a 79% improve.

“If I instructed you initially of 2020 about lockdowns, and faculty and workplace closures, you’d have feared an entire financial collapse,” says Warren Saunders, President of World Gross sales at GfK. “With out detracting from the horrible hardship skilled by so many, from a purely financial perspective, given the size of the problem the trade confronted, T&D has remained impressively resilient.”

What do the approaching quarters maintain for the sector?

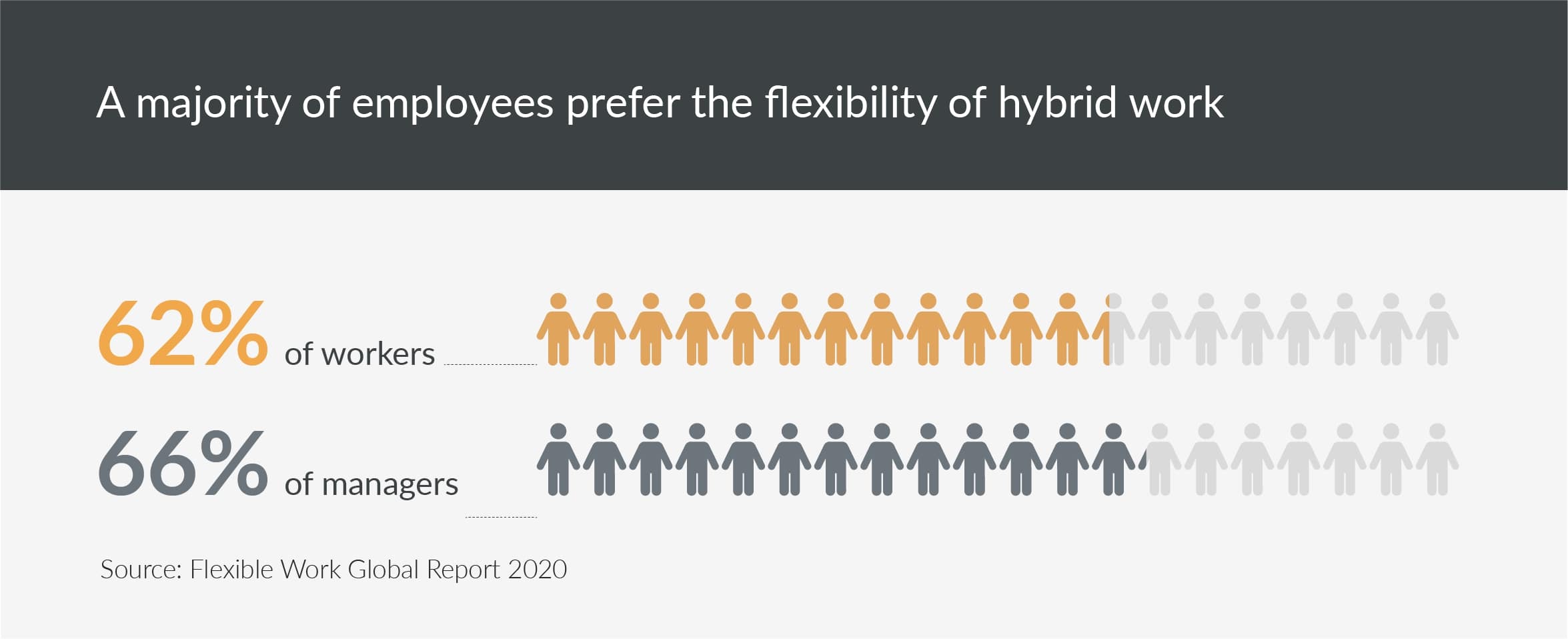

With 2022 in sight, it’s clear {that a} steadiness of workplace and distant work is favored by most. Of employees polled by GfK, 62% of employees and 66% of managers say that whereas they would favor to work largely from house, they might nonetheless like to go to the workplace a minimum of sooner or later per week. In Europe, GfK knowledge reveals 84% French, 74% British, and 72% Germans who labored from house in 2020 want to proceed to take action.

The continuation of hybrid work patterns is nice information for the T&D sector, however analysts are starting to see indicators that the speed of progress may sluggish, a minimum of beneath the double digits skilled in 2021. “Within the final months we’ve seen corporations announce their work-at-home insurance policies, so individuals will now know the way they’re going to work in 2022,” explains Jan Lorbach, Senior World Strategic Insights Supervisor at GfK. “Additionally the present spikes of latest corona instances in lots of areas, particularly within the northern hemisphere, forces many corporations to return a minimum of briefly to stricter earn a living from home insurance policies. This growth may imply a short-term renewed raise in gross sales, however the progress charge is prone to stabilize rapidly because the yr goes on.”

Saunders agrees that progress is prone to be current however slowed, and factors to a possible technique to succeed in buyers whilst demand wanes — providing them premium merchandise as they search to improve. “Lockdowns have meant customers had a considerable amount of disposable earnings, which has been nice for the extra premium manufacturers,” he says. “I feel we’ll see that proceed, definitely into the primary half of 2022, earlier than we return to a extra regular cadence of work-life or journey.”

What are the obstacles to progress within the coming quarters?

Whereas the pandemic and its aftermath have introduced vital features for manufacturers in T&D sector, the approaching quarters current myriad obstacles, and to sidestep them, decision-makers have to be ready.

Provide chain dysfunction

Probably the most widespread subject is provide chain breakdown, the place international and native disruption implies that assembly demand will turn into an intensified problem. New workforce options, logistics networks, and resilience packages are being configured to handle these uncertainties. However such measures take time to kind, and within the quick time period, some corporations will really feel tempted to hike costs to generate income. This may stem demand however may lead to harm to model and market share.

Overstocking is one other answer that manufacturers may flip to. However this technique comprises flaws — pre-loading retailers and channels with particular itineraries represents a scattergun strategy and is prone to lead to merchandise deployed in places that aren’t optimized for revenue.

A scarcity of visibility and foresight causes corporations to overstock, warns Lisa Wiltshire, Insights & Foresights Principal at GfK. The answer? Higher intelligence: “The problem is gathering the intelligence to make the suitable stock calls six to 12 months upfront,” she says. “Due to this fact, understanding shopper demand and market developments is important. Predictive, high-frequency knowledge is the one method to navigate the unpredictability of the present surroundings.”

Market Saturation

Many Tech and Durables merchandise have a lifespan of a number of years, and the customers who buy them have had virtually two years to equip their new earn a living from home setups. Already, GfK is detecting a deceleration of progress in 2021 compared to 2020. As an example, in workplace merchandise, 2020 noticed a soar of +24% in progress on ranges recorded in 2019. In 2021, there may be forecast to be much less progress at +17% by year-end. The same sample may be noticed in Small Home Home equipment. These noticed a 15% rise in 2020 and a 9% rise for 2021. Shopper electronics, nevertheless, exhibited hovering figures between 2020 and 2021 – rising by 15% yr on yr. This represents an enormous increase as compared with the yr earlier than (2019 to 2020) the place progress edged up by 2%.

There may be nonetheless vital progress for companies to make the most of, far above pre-pandemic ranges, however these figures are an indication that some deceleration is on the horizon. Markets are unlikely to witness one other huge improve within the variety of hybrid employees, as they did in 2020. With hybrid work existence already established, and with lots of the merchandise that assist these existence already purchased, manufacturers should put together to satisfy shopper demand in new locations.

Retail channel disruption

Accepted modes of promoting are shifting post-pandemic. In keeping with GfK knowledge, on-line retail in Tech and Durables was up 25% from January to September this yr in contrast with 2020. A return to pre-COVID brick-and-mortar procuring conduct is extremely unlikely – 63% of world respondents surveyed by GfK bought objects on-line to keep away from going into the shop final yr and say they plan to proceed this conduct.

“Strategically, there are a number of instructions for manufacturers within the Shopper Tech and Durables sector to pursue,” says Gonzalo Garcia Villanueva, GfK’s Chief Advertising Officer. “That’s model progress, market understanding, and forecasting. However on the prime of those strikes is the rolling out of e-commerce.”

A renewed shopper deal with worth for cash

Whereas hybrid working has yielded a good surroundings, there are indicators {that a} extra prudent spirit is returning to customers who’re turning into extra centered on worth for cash. GfK’s Shopper Life 2020 report discovered that globally, ‘Thrift’ — being economical, cautious with cash and avoiding excesses — was ranked 32 of 57 guiding rules of life. Within the following yr’s Shopper Life 2021 report, it had risen 2 locations in relative significance, to quantity 30. The identical report from 2021 picks up on themes of decluttering: 36% of world customers agree “I desire to personal fewer however greater high quality objects (garments, expertise merchandise, and many others.)”.

Rising sustainability requirements

There are rewards for manufacturers that develop sustainability as a core pillar of their product, enterprise practices, and advertising, however on the similar time, there are very actual dangers to people who fail to satisfy more and more stringent shopper sustainability requirements. Prospects are extra rigorous than ever within the merchandise they select, searching for out info on all the things from supplies utilized in manufacturing and packaging, to power and transport miles required for supply.

The demand is inconsistent throughout geographies and demographics, however the path of journey is evident. In 2011, 30% of millennials thought of the surroundings when making buy choices, however in 2021, 49% of Gen Z does. GfK’s Inexperienced Shopper Europe report reveals that buyers are actively looking for manufacturers that make environmental motion straightforward and reasonably priced — these customers signify an enormous alternative for proactive manufacturers.

4 methods companies can use to beat these challenges

The market situations approaching can be outlined by instability and unpredictability. However methods may be applied by good enterprise leaders, with entry to the suitable knowledge and evaluation, to assist them thrive within the approaching quarters.

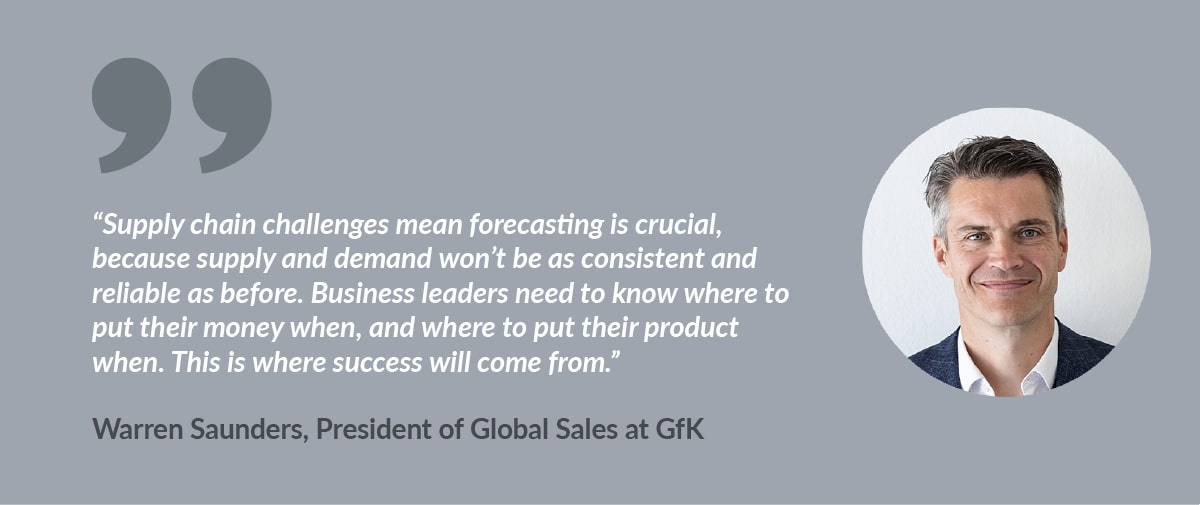

Spend money on perception and foresight

Issues with inconsistent provide have to be managed and balanced with demand so that buying and resourcing choices may be made with agility. The one method to obtain this can be by way of correct, dependable, and real-time point-of-sale knowledge. “Provide chain challenges imply forecasting is essential as a result of provide and demand gained’t be as constant and reliable as earlier than,” says Saunders. “Enterprise leaders must know the place to place their cash when, and the place to place their product when. That is the place success will come from.”

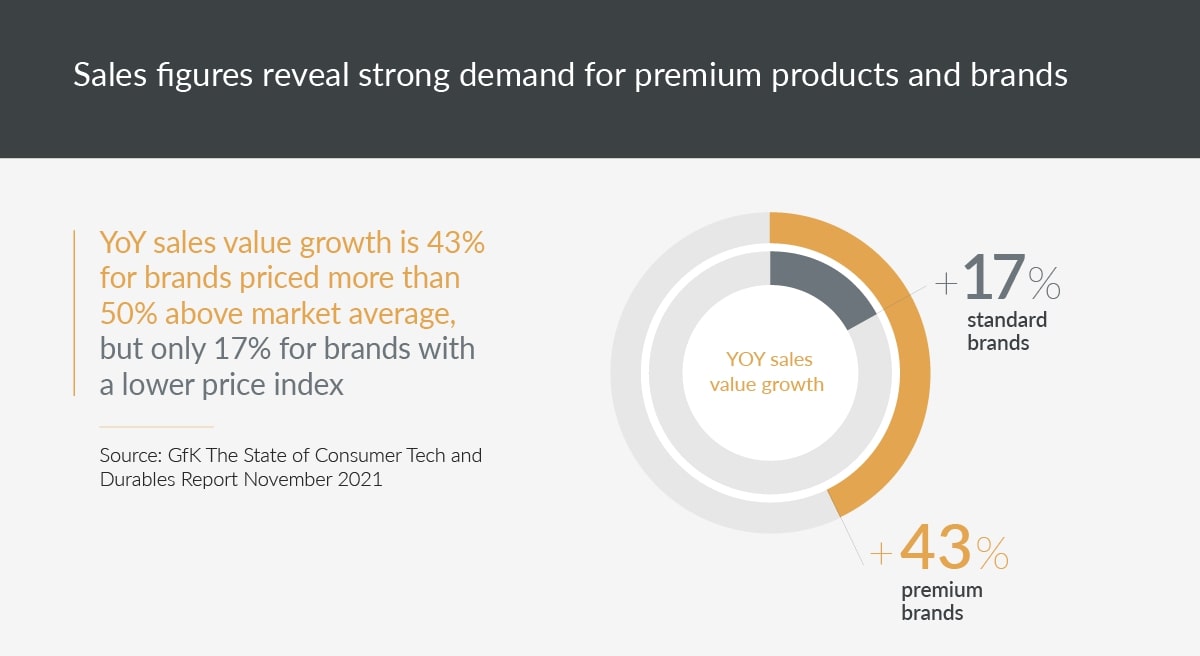

Premiumization might help mitigate market saturation

As market saturation causes a slowdown throughout classes, premiumization will emerge as a tried-and-tested technique of encouraging gross sales. Devising good advertising messages and emphasizing performance and ease of use can encourage clients to improve their house workplace.

This strategy is demonstrated by the sturdy progress of the premium class lately. As famous in GfK’s “The State of Shopper Know-how and Durables” report, international manufacturers with a median product gross sales worth 50% or extra above market common witnessed a 2021 YoY worth progress of 43%, whereas normal manufacturers — these with costs nearer to the market common — noticed progress of solely 17%.

Concentrate on offering seamless retail experiences

A borderless, handy and ideally gratifying retail expertise is of ever-increasing significance. Customers shifting away from lockdown-enforced e-commerce are cherry-picking the place and after they interact with completely different gross sales channels. Little question the longer term is largely digital: of on-line patrons surveyed by GfK, 51% would advocate the retailer. Of offline patrons, solely 42% would. Manufacturers who precisely gauge how their customers are shopping for — they may very well be procuring in social media, click-and-mortar, and even cross realities — after which meet them there, can faucet into substantial wells of demand.

Credible sustainability messaging and product growth

Sustainability is more and more a problem that extra customers are centered on, however manufacturers can’t meet their expectations with advertising messaging alone. Any try to chop corners is prone to be caught and punished. Customers had been as soon as delay by inexperienced messaging as a result of it steered a dearer worth, however GfK analysis reveals that value is declining as a barrier to inexperienced consumption. In 2011, 61% of world respondents agreed that “the environmentally pleasant options for lots of the merchandise I exploit are too costly.” In 2020, 52% agreed with this assertion.

Clever knowledge and insights are the way in which ahead

The constructive progress we now have seen in shopper demand for Tech and Durables during the last years is ready to proceed. However as a result of many customers have already geared up their earn a living from home setups with the suitable expertise, general demand for merchandise will finally flatten. Companies might want to watch market and shopper developments fastidiously and have entry to as near real-time knowledge as doable to grasp what’s driving demand, and forecast the place it should shift to subsequent. Daring management, guided by the suitable intelligence, can faucet into this demand, and capitalize on the brand new hybrid future.

Learn the way the present trade panorama is shifting

FAQs

What’s hybrid working?

Hybrid work is a mixture of earn a living from home and extra conventional office-based work. Completely different organizations have completely different hybrid work insurance policies, however, because the COVID-19 pandemic, providing employees flexibility on the place they work from is turning into more and more frequent.

How has earn a living from home affected Shopper Tech and Durables?

The Tech and Durables sector has witnessed distinctive progress since earn a living from home turned extra widespread, with international gross sales figures 14% greater than they had been in pre-pandemic 2019. Gross sales haven’t been restricted to house workplace necessities – extra time spent at house has meant demand for leisure merchandise like TVs and sizzling beverage makers has additionally shot up.

What are buyers shopping for to enhance their earn a living from home setups?

Shoppers have turned to merchandise that improve their house workplace, equivalent to webcams, gross sales of which elevated 45% between January and September 2021 in comparison with the identical interval of 2020. Screens had been additionally up 31%, and PC/VOIP headsets 37%.