The findings of the August 2021 version of The CMO Survey had been printed final month. The CMO Survey is led by Dr. Christine Moorman and sponsored by Duke College’s Fuqua Faculty of Enterprise, the American Advertising Affiliation and Deloitte LLP.

That is the primary of three posts that can talk about a number of the B2B-specific findings from The CMO Survey. The August survey outcomes are primarily based on responses from 282 senior advertising and marketing leaders at for-profit firms primarily based in the US. Over two-thirds of the respondents (69.8%) had been affiliated with B2B firms, and 94.1% had been VP degree or above. The survey was within the subject August 4-25, 2021.

The CMO Survey is carried out semi-annually, and it supplies a wealth of data. Dr. Moorman and her colleagues sometimes produce three studies for every version of the survey.

- “U.S. Highlights and Insights Report” – It is a comparatively transient and graphically-rich report that gives largely top-level outcomes, together with an evaluation of these outcomes and main advertising and marketing developments.

- “Topline Report” – This report supplies response knowledge on the combination degree for all survey questions.

- “U.S. Agency and Trade Breakout Report” – That is essentially the most detailed report. It supplies response knowledge by 4 main financial sectors (B2B product firms, B2B companies firms, B2C product firms and B2C companies firms), fifteen trade sectors, firm dimension and quantity of web gross sales. This report is often fairly prolonged, however it supplies essentially the most granular view of the survey knowledge.

The CMO Survey doesn’t state that it makes use of a consultant pattern of senior advertising and marketing leaders at U.S. for-profit firms. Due to this fact, the survey findings can’t be projected to all the inhabitants.

On this sequence of posts, I will be discussing the responses of B2B entrepreneurs solely except in any other case indicated. The odds and different numerical values in these posts are the imply of survey responses, additionally except in any other case indicated.

Marketer Optimism Reaches Pre-Pandemic Ranges

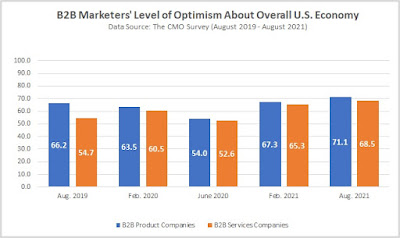

On common, the optimism of B2B entrepreneurs has returned to pre-pandemic ranges. The survey requested contributors to charge their degree of optimism relating to the general US economic system on a 100-point scale, with “0” being least optimistic, and “100” being most optimistic. The next chart reveals how B2B entrepreneurs rated their optimism within the 5 surveys carried out since August 2019.

It additionally seems, nonetheless, that entrepreneurs’ optimism could also be moderating. The August survey requested contributors in the event that they had been kind of optimistic in regards to the total US economic system in comparison with the earlier quarter. The next desk reveals how B2B entrepreneurs responded.

Entrepreneurs’ optimism seems to be reflecting the trajectory of total financial progress within the US. In response to the Bureau of Financial Evaluation, US actual GDP grew at an annualized charge of 6.3% within the first quarter of 2021 and at an annualized charge of 6.7% within the second quarter.

The Convention Board is at present forecasting that actual GDP will develop at an annualized charge of 5.5% within the third quarter and by 3.9% within the fourth quarter. For all the 12 months of 2021, The Convention Board expects actual GDP progress to develop by 5.9%, slowing to three.8% in 2022.

The State of Advertising Spending

The CMO Survey consists of a number of questions pertaining to the state of selling budgets and spending that often obtain little bit of consideration. The survey requested contributors to estimate what proportion of their firm’s whole income is represented by advertising and marketing bills. The next chart reveals how entrepreneurs from B2B product firms and B2B companies firms responded to this query within the surveys carried out since August 2019.

In a current publish, I mentioned a number of the findings of Gartner’s CMO Spend Survey, 2021. The “headline” discovering of that analysis pointed to a major decline in advertising and marketing budgets as a proportion of firm income. Gartner discovered that the imply proportion of whole firm income allotted to advertising and marketing in 2021 is 6.4%, down from 11% in 2020. The imply proportion for B2B firms represented within the Gartner survey was 6.2%.

The above chart additionally reveals a decline in advertising and marketing spending as a proportion of firm income within the August 2021 version of The CMO Survey, in comparison with the earlier 4 surveys. The decline occurred in each B2B product firms and B2B companies firms.

In its survey report, Gartner handled the decline within the proportion of selling budgets to firm income as proof that advertising and marketing budgets have been lower – or at the least that they have not recovered from cuts that occurred final 12 months. I do not imagine the survey knowledge helps that conclusion.

As a ratio metric, the proportion worth is clearly affected by each parts of the ratio. An organization’s advertising and marketing funds could have been elevated in absolute phrases, however the proportion would nonetheless fall if firm revenues grew sufficient in the identical timeframe.

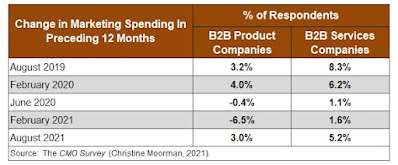

The CMO Survey supplies a extra direct measure of modifications in advertising and marketing spending. The survey requested contributors to estimate by what p.c their total advertising and marketing spending modified within the twelve months previous the survey. The next desk reveals how B2B entrepreneurs answered this query within the 5 surveys carried out since August 2019.

This desk clearly reveals that advertising and marketing spending within the survey respondents’ firms slowed or declined within the June 2020 and February 2021 editions of the survey. Nonetheless, entrepreneurs in each B2B product firms and B2B companies firms reported will increase in spending within the newest survey.

My view is that that is a type of points the place averages aren’t notably significant. Actually, The CMO Survey discovered that modifications in advertising and marketing spending different considerably throughout industries. For instance, within the August 2021 version of the survey, respondents with banking, finance and insurance coverage firms reported a imply improve of 20.2% over the previous twelve months, whereas respondents with manufacturing firms reported a imply improve of solely 3.6%

In my subsequent publish, I am going to talk about extra of the B2B findings from the August version of The CMO Survey.

High picture supply: The CMO Survey