As inflation reshuffles budgets, the nice-to-haves are likely to land on the chopping block. And for a few third of U.S. customers, that features the sustainable merchandise that price a bit bit extra, in keeping with a report from market analysis firm Savanta.

The report, which surveyed greater than 12,000 adults from the U.S., U.Ok. and Canada between April 11-28, kinds customers into seven teams. It reveals that regardless of a common concern about price of residing, about one-quarter (24%) of respondents are nonetheless buying solely with manufacturers they understand as “moral” and dedicated to making a constructive affect.

“Economists usually confer with sustainable merchandise as luxurious items, no less than in a rustic just like the U.S.,” defined Dirk Mateer, economics professor on the College of Texas at Austin. “So that you’re going to chop again on these luxurious purchases. There’s simply there’s no different means round it that these are unhealthy occasions for sustainable firms.”

A few of that is to be anticipated, economists instructed Adweek. Nevertheless it doesn’t imply manufacturers must also reduce sustainability initiatives or product traces. In the long term, these enterprise practices are prone to repay, consultants mentioned—particularly as youthful generations acquire spending energy.

“It’s straightforward to take a look at this report and say, ‘Wow, folks don’t actually care that a lot,’” Nikki Lavoie, evp of worldwide expertise technique at Savanta, instructed Adweek. “Nevertheless it’s really the reverse. It’s the truth that occasions are so robust, and persons are nonetheless prepared to boycott manufacturers or focus their whole buying finances solely on sustainable manufacturers—to me says lots.”

Retrenching towards core prospects

As customers go for cheaper options, some firms will focus much less on accessibility and extra on their core client: that subset of devoted, sustainability-minded customers who both have extra money to spend or will prioritize the climate-friendly choices.

Sustainable manufacturers “would positively retrench” towards their core buyer base, Mateer defined, generally making the class much less accessible to lower-income customers.

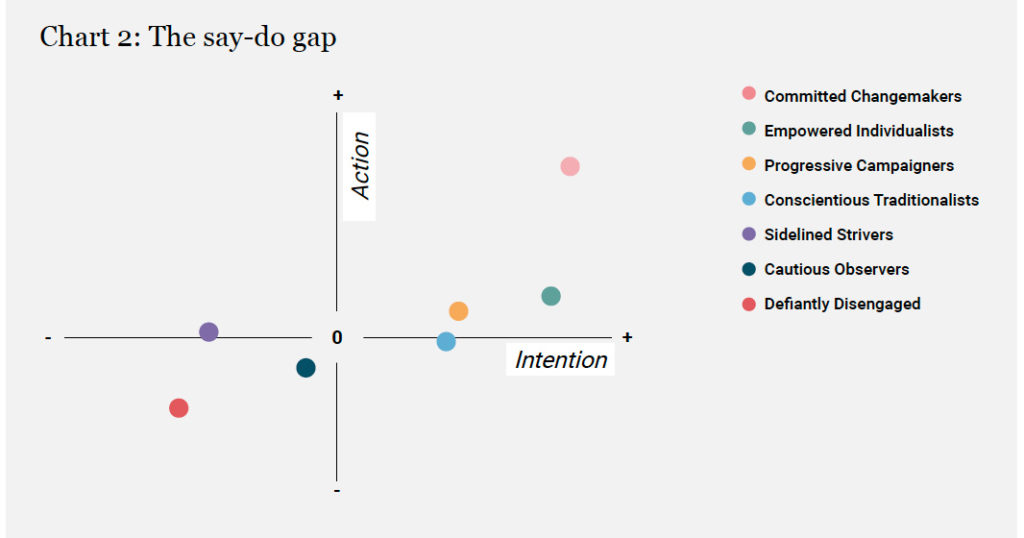

Savanta’s segmentation plots customers alongside a graph that goals to visualise the “say-do hole”—which highlights the distinction between what customers say they worth and the place they really put their cash—for manufacturers to grasp extra concerning the core cohorts to focus their efforts on.

When shopping for meals and groceries, 62% of survey respondents reported that worth for cash is a prime concern, alongside high quality and low costs. Within the “life-style” class, which incorporates tech, furnishings, clothes and private care, 76% of customers purchase from a wide range of retailers to fulfill their wants—of which worth ranks highest. About one-fourth (24%) purchase solely from these they see as having a constructive affect.

At one finish of the spectrum are the “dedicated changemakers” and the “empowered individualists,” who’re almost certainly to decide on sustainable choices when it comes to life-style, vitality use, transportation, cash and labor, the report says. On the different finish of the spectrum are the “defiantly disengaged”—the one group that basically doesn’t care in any respect about sustainable residing.

Within the center are the “progressive campaigners,” “conscientious traditionalists,” “sidelined strivers” and “cautious observers.” Every of these teams cares about sustainable residing however has totally different ranges of constraints that may grow to be boundaries to motion.

The true trickle-down economic system

Even when the financial situations of the second imply sustainable merchandise grow to be much less accessible to lower-income customers within the quick time period, that may nonetheless flip into general progress in the long term.

Luc Wathieu, advertising and marketing professor at Georgetown College, factors to what Tesla has achieved for electrical automobiles for instance of how demand for extra sustainable merchandise could be catalyzed by the wealthy and grow to be extra accessible because the class grows and develops.

Shoppers have been calling for a inexperienced revolution that has not materialized.

Nicole Corbett, vp of thought management at NielsenIQ

“It’s fascinating that we attempt to promote that ‘sustainability benefit’ to the wealthy as one thing that’s [available] for these ones who can afford it,” Wathieu defined. “There may be some form of elite concern for it, and that may trickle down. That’s perhaps the actual trickle-down economic system.”

A few of this may be seen in Savanta’s report information: 87% of the dedicated changemakers, who are typically extra prosperous, would contemplate or have already bought an electrical car. Amongst cautious observers and sidelined strivers, who are likely to have decrease incomes, that stat is between 52% and 68%.

A rising demand for sustainable merchandise

And regardless of the financial downturn, there’s proof that buyers’ give attention to sustainability continues to develop. NielsenIQ’s 2023 Sustainability Report, out this week, reveals that 42% of respondents contemplate the sustainability or environmentally pleasant claims of a product to be “rather more necessary” than two years in the past. One other 27% see them as “a bit extra necessary.” It additionally notes that whereas the economic system could also be tight now, we’re solely starting to see the impacts of local weather change.

“Shoppers have been calling for a inexperienced revolution that has not materialized,” Nicole Corbett, vp of thought management at NielsenIQ, mentioned in an announcement. “Greenwashing and inaction from manufacturers and retailers has left customers with various ranges of belief in these events to ship.”

Youthful folks, specifically, report the next concern for sustainability and local weather points. In Savanta’s survey, local weather change ranked as a prime three concern amongst youthful respondents, however behind cost-of-living and psychological well being. Notably, although, these youthful customers are the almost certainly (22%) to have participated in a boycott of a model or product due to sustainability points.

“What we’ve seen within the final couple of years is lots much less model loyalty, notably among the many youthful technology—so the Gen Zs … let’s see what the alphas do once they’ve bought their spending energy,” Lavoie mentioned.

“In case you are not taking part in the sustainability sport, fairly quickly you’re not even gonna be within the working,” she added.