Apple first introduced its plan to create a purchase now, pay later choice for the Apple Pockets in July 2021, but it surely was not till this week that the service formally launched in the USA.

Apple Pay Later permits customers to separate purchases — retail, ecommerce, in-app — into 4, interest-free funds. The service may encourage some customers to make purchases sooner, which, in flip, may enhance each omnichannel retail and ecommerce.

In its launch, the corporate stated its new BNPL service was created “with customers’ monetary well being in thoughts,” including:

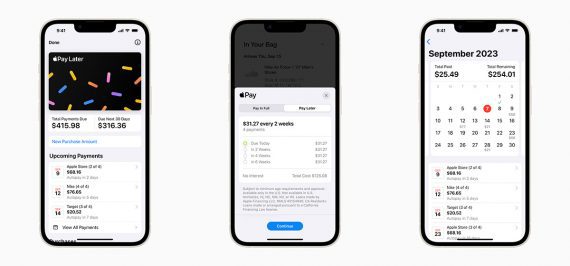

Apple Pay Later permits customers to separate purchases into 4 funds unfold over six weeks with no curiosity or charges. Customers can simply observe, handle, and repay their Apple Pay Later loans in a single handy location in Apple Pockets. Customers can apply for Apple Pay Later loans of $50 to $1,000, which can be utilized for on-line and in-app purchases made on iPhone and iPad with retailers that settle for Apple Pay.

Customers can observe, handle, and repay their Apple Pay Later loans in Apple Pockets. Click on picture to enlarge. Supply: Apple.

Retailers already accepting Apple Pay want no further motion — the BNPL choice ought to work routinely. Retailers on Shopify, BigCommerce, and different platforms can activate Apple Pay.

Apple’s BNPL Benefit

Apple Pay Later may supply 4 vital benefits for customers in comparison with different providers.

Huge consumer base. By some estimates, 9 out of 10 bodily retail places in the USA settle for Apple Pay. Furthermore, roughly 48% of U.S. smartphones are Apple gadgets. Backside line, Apple’s huge consumer base may quickly allow vital market share in the BNPL house.

Trusted model. Many shoppers may choose Apple Pay Later over different suppliers or use BNPL for the primary time as a result of they belief the Apple model and its repute for delivering safe, high quality services and products.

Straightforward to entry. The service is obtainable in Apple Pockets. Customers can apply for brand spanking new loans, observe excellent loans, and handle compensation in an app they have already got. As soon as the consumer has added it, Pay Later needs to be prepared for purchases.

Cheap. The service doesn’t cost curiosity and has no charges if the consumer remits on-time funds. Even people flush with money may contemplate taking out an interest-free, $1,000 mortgage on occasion. A consumer’s personal financial institution could cost, for instance, a debit charge, however Apple Pay Later itself is affordable.

Influence

The launch of Apple Pay Later may immediate certified customers to strive the service, making a short-term bump in gross sales.

retailers ought to first be certain they’ll settle for Apple Pay. Most ecommerce platforms permit sellers to just accept Apple Pay and show its button.

Sellers can tout Apple Pay Later — significantly to customers on an iPhone — and the comfort of splitting purchases into interest-free installments. Promotional choices may embrace a banner on checkout pages and even an embedded video demonstrating how one can use the service or, for that matter, different BNPL suppliers.

There’s additionally the chance to leverage Apple’s model. By providing Apple Pay Later, retailers may gain advantage from the belief and loyalty related to the corporate. This affiliation may construct credibility — fostering belief and inspiring repeat purchases, as customers know they’re working with Apple.

Finally, retailers could not know definitively if Apple Pay Later drives new or sooner gross sales. Nonetheless, there’s no draw back to selling it.