|

| Picture Supply: Gartner, Inc. |

Final month, Gartner launched the findings of its CMO Spend Survey, 2021. The agency hosted a webinar and printed a report discussing the findings of this analysis.

The Gartner survey was performed from March by way of Could of this yr. The survey produced 400 responses from advertising and marketing choice makers and influencers situated in North America, Europe and the UK. Respondents have been with organizations working in 9 business verticals, and 81% have been with organizations having $1 billion or extra in annual income. Subsequently, this survey primarily captured the views and experiences of entrepreneurs in giant enterprises.

Gartner expressly famous that the outcomes of this survey don’t signify the market as a complete, however solely mirror the feelings of the respondents surveyed.

Advertising Budgets Fall

The “headline” discovering of the Gartner analysis factors to a big decline in advertising and marketing budgets as a proportion of firm income. Gartner discovered that the imply proportion of whole firm income allotted to advertising and marketing in 2021 is 6.4%, down from a median of 11% in 2020.

The imply proportion of income allotted to advertising and marketing in 2021 is about the identical in each B2B and B2C firms. The imply proportion for B2B firms represented within the survey was 6.2%, whereas the imply proportion for B2C firms was 6.6%.

Gartner’s analysis additionally revealed that advertising and marketing budgets (as a proportion of income) declined in all 9 of the industries represented within the survey, though the impression diversified significantly. In manufacturing firms, the imply proportion of whole firm income dedicated to advertising and marketing fell from 12.7% in 2020 to five.8% in 2021, a decline of 6.9 proportion factors. In distinction, the imply proportion in shopper merchandise firms declined by solely 2.5 proportion factors.

Digital Channels Dominate

The Gartner survey discovered the pure-play digital advertising and marketing channels now command greater than 70% of the overall advertising and marketing finances within the common firm represented within the survey. Nevertheless, the survey additionally revealed that firms’ funding plans for each digital and offline channels range significantly.

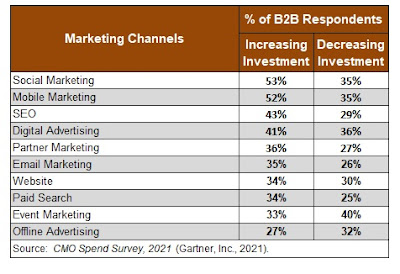

The next desk reveals the odds of B2B survey respondents who stated they’re rising and reducing their investments (2021 vs. 2020) within the advertising and marketing channels lined within the survey. These responses point out that B2B survey respondents are taking numerous approaches to finances allocation selections.

It is also noteworthy that price financial savings was not a main driver of the modifications in channel priorities. Solely 24% of the survey respondents stated they’d reprioritized channels with a view to cut back prices.

Within the webinar supplies, Gartner argued that “the age of the digital versus offline finances has come to an finish.” The agency famous that 24% of the finances historically spent on TV is predicted to shift from broadcast and cable TV to streaming video this yr.

Different Essential Findings

Gartner’s survey produced a number of different attention-grabbing findings. Listed here are just a few of the opposite main outcomes.

Martech Spending – Advertising expertise nonetheless instructions the most important proportion of the advertising and marketing finances. In 2021, the imply proportion of the overall advertising and marketing finances allotted to martech was 26.6%, up barely from 2020 (26.2%). As well as, greater than two-thirds (68%) of the survey respondents stated they count on their martech finances to extend additional within the subsequent fiscal yr.

Finances Allocations for Applications and Operational Areas – Gartner additionally requested survey members how they allotted their finances throughout ten advertising and marketing packages and operational areas. The highest 4 packages/operational areas (by imply proportion of finances) have been:

- Digital commerce (12.3%)

- Advertising operations (11.9%)

- Model technique (11.3%)

- Advertising analytics (11.0%)

In-Housing Continues – Within the 2021 survey, the imply proportion of whole advertising and marketing finances allotted to exterior companies was 23.0%, down barely from 23.7% within the 2020 version of the survey. However this slight decline does not inform the entire story. The respondents to the 2021 survey reported that 26% of the work beforehand outsourced to exterior companies had been moved in-house over the previous 12 months.

My Take

Gartner’s newest CMO Spend Survey supplies a number of vital insights for entrepreneurs, however I am somewhat perplexed by the survey’s discovering in regards to the “decline” in advertising and marketing budgets. Actual-time information concerning whole advertising and marketing spending is tough to acquire, however we do have comparatively present information about promoting spending. And most of that information signifies that promoting spending is displaying a big rebound in comparison with 2020. For instance:

- In keeping with Normal Media Index’s U.S. Advert Market Tracker, the U.S. promoting economic system grew 35.2% in June, in comparison with June of 2020. This was the fourth consecutive month of double-digit progress in comparison with the identical months of final yr. The June determine additionally represented a slight improve (0.03%). in comparison with June of 2019.

- Promoting revenues for the primary six months of 2021 at each Alphabet (the mum or dad firm of Google) and Fb grew by about 50% in comparison with the primary six months of final yr, in keeping with the businesses’ earnings reviews.

The following version of The CMO Survey directed by Dr. Christine Moorman at Duke College’s Fuqua Faculty of Enterprise needs to be printed later this month. That survey usually asks members about their advertising and marketing budgets as a proportion of firm income and about modifications within the advertising and marketing finances within the prior 12 months. Will probably be attention-grabbing to see if the findings of this analysis line up with the findings of Gartner’s survey.